Whether you’re chasing travel savings, exploring your next home move or building long-term financial wellness — NMB Perks brings you both lifestyle and homeownership benefits in one place at no cost to you.

Over 18,500

Verified Customer Reviews

4.89/5

Average Review Rating

Live Better Today. Build Better Tomorrow.

Personal mortgage guidance

From first-time buyers to seasoned homeowners, our mortgage experts guide your team through every step, with clarity, care and no surprises.

Shop your favorite brands

Skip the hunt for promo codes. Activate offers through NMBPerks and earn real cash back when you shop top retailers and everyday essentials.

Get paid to fly

Earn cash back when you book eligible airfare. Whether it’s a quick work trip or a big getaway, your flight just earned you savings.

Smart refinance strategies

Lower your rate, shorten your term or tap equity when it makes sense. We help your employees turn “what if” into “what’s next.”

Interactive tools & education

Empower your team members with calculators, checklists and bite-sized content that demystifies home-ownership and financial health.

Cash back on hotels

Treat yourself — from weekend stays to dream vacations. Book through the NMBPerks portal and enjoy cash back on thousands of hotels worldwide.

Earn rewards on car rentals

Hit the road for less. Choose from leading rental companies and earn cash back on your next car rental through NMBPerks.

Cash back on airport transfers

Ride in comfort and earn cash back along the way. Book private transfers or shuttle options with no hidden fees and easy savings.

A Partnership Built to Elevate Your Employee Experience

NMBPerks is powered by a strategic collaboration between Nationwide Mortgage Bankers (NMB) and LaaSy, bringing together two categories of value employees actually care about: lifestyle savings and long-term financial wellness.

LaaSy delivers the technology and travel-and-shopping rewards platform your team uses every day, while NMB provides the homeownership guidance and financial support that help employees build real wealth over time. For employers, this partnership means one seamless platform, one brand experience and one turnkey way to offer a meaningful benefit without adding administrative lift.

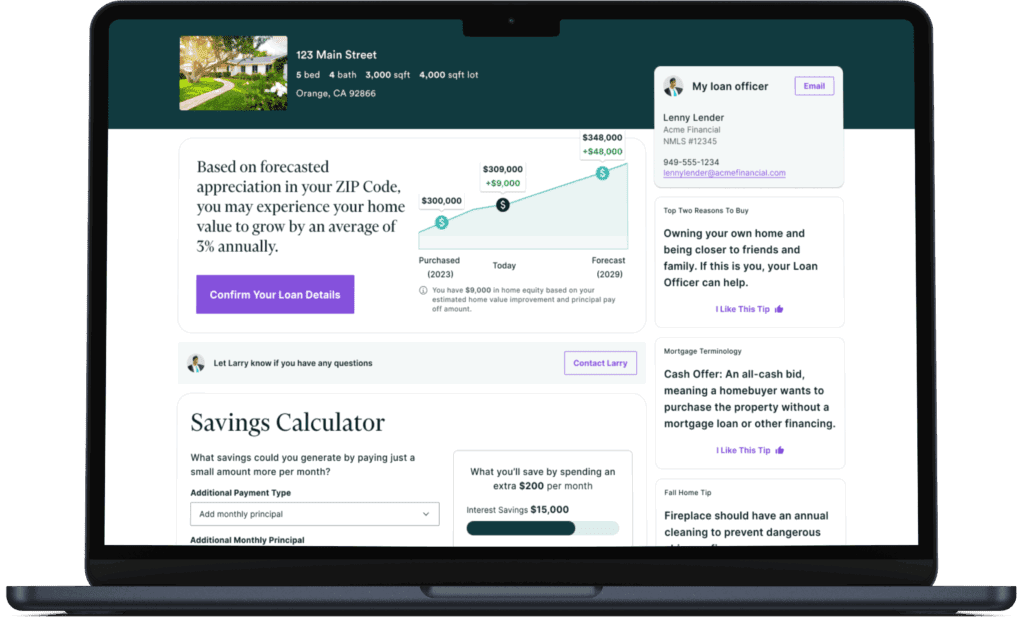

Help your team members stay in control of one of their most important assets.

Empower them with our Free Home Report.

🏡 Current Home Value

Team members can see what their home is worth in today’s market.

💰 Equity Position

Track how much equity they’ve built and what it could mean for their next move.

Stay informed with recent sales and local market activity.

💡 Practical Tips

Get ideas on how to increase their home’s value or put their equity to work.

Incredible value just for your team members:

$1,800 Closing Cost Credit*

Clear Guidance, Not Confusion

Our partnership with NMB takes the guesswork out of home financing with one-on-one support from real loan officers who listen, explain, and walk your team members through every step

Speed and Simplicity

NMB’s digital tools make applying, uploading documents, and closing fast and frustration-free, so your team members can focus on life, not paperwork

Tailored Home Loan Solutions

Whether it’s buying, refinancing, or unlocking equity, NMB looks at each person’s full financial picture to recommend the right move — not just any move.

Trusted Partner, Not a Transaction

NMB builds relationships that last beyond the loan, offering lifetime mortgage checkups, insights, and proactive help whenever circumstances change.

* Credit valid through Nationwide Mortgage Bankers, INC (NMB) only as a part of this program. Offer must be presented/mentioned at time of application. Closing Cost Credit will be applied at time of closing. Applicant subject to credit approval. If loan does not close for any reason, costs will not be refunded. This offer and/or receipt of application does not represent an approval for financing or interest rate guarantee. This coupon cannot be redeemed for cash/has no cash value. Restrictions may apply, contact NMB for current rates or more information.

Getting started takes just minutes.

Choose the Right Way to Launch NMBPerks

Every organization is different. Some want to move fast and start giving their people access to perks right away. Others want a fully custom experience in their own brand with a heavier engagement strategy. With our partners at LaaSy, you can choose the path that fits your goals. Both options give your employees access to the same powerful mix of travel and shopping savings plus NMB’s homeownership and financial wellness support.

Path #1

Instant NMBPerks Platform

Need speed and simplicity? This option gets your employees onto NMBPerks quickly, using our standard NMBPerks-branded portal that is already live and proven. Your company is set up as a group inside the platform, employees receive a unique access code to join, and LaaSy handles the heavy lifting on onboarding communications and engagement.

- Want to start offering perks as soon as possible

- Do not need their own logo, URL or custom design yet

- Prefer low lift for HR and internal marketing teams

- Want a simple way to test engagement and adoption

Path #2

Custom Branded Perks Portal

For larger employers with a strong culture and brand presence, LaaSy can build a fully branded perks experience just for your organization. This includes your logo, your URL, tailored messaging, launch events, webinars and a strategic engagement plan. NMB’s financial wellness and homeownership tools are woven into your custom branded perks portal.

- Want the perks experience fully aligned to their brand

- Have a larger or more distributed workforce to engage

- Are ready to invest in a launch and engagement strategy

- Prefer custom design, communications and reporting

Over 18,500

Verified Customer Reviews

4.89/5

Average Review Rating

Choosing a new employee program can feel like a big decision, and we want you to feel confident every step of the way. If you’re curious about how NMBPerks works, what it includes or how it can support your people, this form is the perfect place to start. Tell us what you’re wondering about and our team will follow up with helpful, practical information — no sales pressure, just clarity.

Discovery Form

the fastest growing lenders in America.

Nationwide Mortgage Bankers, Inc. (NMB), going by NMB Home Loans, Inc. in the states of AL, AZ, GA, IL, IA, KS, KY, LA, MN, MT, ND, OK, PA, SC, SD, TX, WV and as NMB Home Loans in MA | NMLS# 819382 | 1305 Walt Whitman Road, Suite 100, Melville, NY 11747 | (833) 700-8884 | For licensing information, go to: www.nmlsconsumeraccess.org. | www.nmbnow.com. NMB is in no way affiliated with Nationwide Mutual Insurance Company. “NMBNOW” is a registered DBA of Nationwide Mortgage Bankers, Inc. All loans are subject to credit and appraisal approval. Not all applicants may qualify. Some products and services may not be available in all states. NMB is not acting on behalf of or at the direction of FHA/HUD/USDA/VA or the federal government. This is an advertisement. Licensed under the California Finance Lenders Law by The Department of Financial Protection and Innovation #60DBO73939 | Georgia Residential Mortgage Licensee | MA Mortgage Lender License #ML819382 | Licensed by the N.J. Department of Banking and Insurance | Licensed by the New York Department of Financial Services | Rhode Island Licensed Lender | Licensed by the Virginia State Corporation Commission. Additional state licensing information can be found at https://nmbnow.com/disclosures-and-licensing/.

By refinancing your existing home loan, your total finance charges may be higher over the life of the loan.