Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

“Mortgage rates dipped slightly last week, with the 30-year average nearing 6.50%, while the 10-Year Treasury yield briefly fell below 4% for the first time since October. Market volatility remains high as investors react to new tariffs, strong job data, and upcoming inflation reports.”

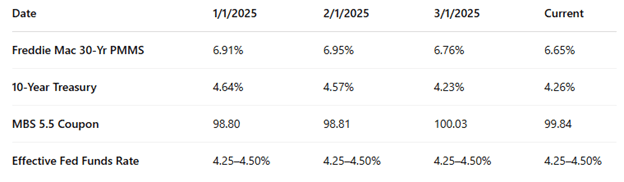

Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

“Volatility will remain elevated in the bond and stock markets this week, as participants digest new data and continue to assess the impact of the new tariffs.”

Market Overview

With rates trending downward, the market showed strong activity last week. The Freddie Mac average 30-year fixed rate sits at 6.64% as of last Thursday—down just 1 basis point from the previous week. However, we saw rates decline sharply on Thursday and Friday, which was not reflected in the published index. By the end of the week, average rates were closer to 6.50%.

Over the past four weeks, the index has moved only slightly—hovering up or down by a basis point or two. If last week’s sharp decrease in rates holds into this week, we could see a more noticeable drop in the index in the coming days. The average 30-year rate has now stayed below 7% since mid-January, a notable shift in the market.

The 10-Year Treasury yield also saw significant movement, dropping sharply last week and closing at 3.99% after dipping as low as 3.86% intraday on Friday. This marks the first time the 10-year has closed below 4% since early October. That said, it’s on the rise again this morning.

Since mid-January, mortgage rates have declined by 40 basis points from the recent high of 7.04%. While many in the mortgage industry expected a more aggressive drop, the slow and steady decline has still been welcomed. Last week, however, volatility returned with force.

The Trump Administration’s new tariff policies went into effect on April 2, and the uncertainty surrounding their impact on the U.S. economy and inflation has driven volatility higher. On Friday, Fed Chairman Jerome Powell noted that the economic impact of the tariffs would likely be greater than expected. He emphasized that the Fed is in no rush to adjust interest rates, signaling a cautious, data-driven approach.

Equity markets have reacted negatively to the tariffs, with sharp selloffs fueled by fears of prolonged trade wars. Powell also indicated that the tariffs could result in both higher inflation and weaker economic conditions in the U.S. With so much uncertainty, the Fed will likely remain conservative and reactive to new economic data.

Employment Data and Fed Meeting Outlook

Last week’s focus was on employment, with the March report showing 228,000 jobs added—well above the 140,000 expected. However, strong employment data was overshadowed by growing concerns over global trade tensions. While the administration views the tariffs as a long-term economic strategy to boost U.S. manufacturing, many economists are concerned about short-term consequences: slower growth, higher inflation, and increased unemployment.

Long-term inflation expectations have climbed to new highs, reflecting concern over the broader effects of these policies. This week, inflation takes center stage with the Consumer Price Index (CPI) and Producer Price Index (PPI) releases on Thursday and Friday, respectively. We’ll also see the release of the March FOMC meeting minutes on Wednesday, along with several Fed speaking engagements throughout the week.

So far today, rates are rising, reversing some of the gains from Friday’s bond market rally. The 10-Year Treasury is up roughly 13 basis points to 4.13%, and mortgage-backed securities are down 25–35 basis points from Friday’s close. Volatility is expected to remain elevated as the market continues to process fresh economic data and developments related to the tariffs.

Thanks for reading—more market insights coming your way next week!