Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

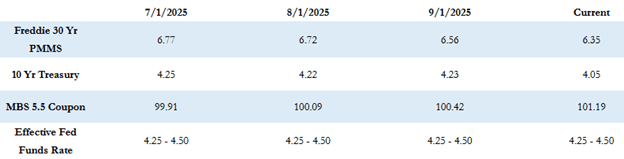

The Freddie Mac 30-year fixed average has dropped to 6.35%, its lowest point in nearly a year, while the 10-year Treasury yield has slipped to 4.05%. Investors and homebuyers alike are watching closely as the Federal Reserve prepares for its September meeting, where a rate cut of at least 0.25% is widely expected. With inflation still above target but labor market weakness dominating recent data, mortgage rates are trending lower, creating optimism for both homebuyers and refinancing opportunities.

Let’s take a look at the latest trends, rate movements, and what to watch for in the coming weeks.

“Other than the Fed announcement there is very little on the economic calendar this week so all eyes will be on the rate decision and subsequent press conference with Chairman Powell at 2:30 on Wednesday”

Rate Movement

The Freddie Mac average 30-year fixed rate dropped to 6.35% as of last Thursday, down 15 basis points from the prior week. That puts the maximum APR for 30-year fixed rate loans at roughly 7.85% (6.35 + 1.50). This marks the seventh consecutive week of declines, with last week’s decrease being the largest weekly drop in the past year. The 10-year Treasury yield closed at 4.06%, down 3 basis points from the week prior.

Economic and Fed Outlook

Rate expectations have shifted in recent weeks but remain fluid as markets balance weaker labor market data against stubborn inflation. Mortgage rates continue to trend downward, creating optimism for homebuyers and current homeowners who may now have opportunities to refinance.

August’s CPI and PPI data came in slightly hotter than expected. While inflation remains above the Fed’s 2% target, the results were not strong enough to overshadow labor market weakness or deter the Fed from easing monetary policy this week. The Federal Open Market Committee (FOMC) is expected to cut rates by 0.25%, with a small chance of a 0.50% cut.

This FOMC meeting will also include the committee’s Summary of Economic Projections, offering insight into the expected path of interest rates over the next year. Since markets have already priced in a rate cut, a surprise—either no cut or a larger 0.50% cut—could trigger significant volatility in the bond markets.

This Week’s Schedule

- Wednesday: FOMC interest rate decision & press conference (2:30 PM EST)

- Economic calendar otherwise light

So far today, MBS prices are better by about 5–10 basis points compared to Friday’s close, and the 10-year Treasury has slipped a few basis points to 4.03%.

We’ll continue to monitor these developments closely and provide updates as new data and Fed commentary emerge. Together, let’s stay informed and prepared as shifting rate conditions shape opportunities for both homebuyers and homeowners in the months ahead.