Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

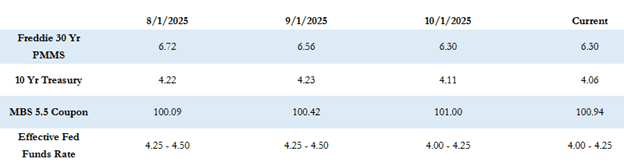

Mortgage rates remained stable last week, with the Freddie Mac 30-year fixed average holding at 6.30% for the third consecutive week. The 10-year Treasury yield declined slightly to 4.06%, reflecting investor caution amid the ongoing partial government shutdown. Markets are now focused on upcoming inflation data releases—if they are not delayed—as well as commentary from Federal Reserve officials ahead of the late-October FOMC meeting. Despite missing employment data and heightened uncertainty around fiscal policy, markets are currently pricing in a 0.25% Fed rate cut at month’s end.

Let’s take a look at the latest trends, rate movements, and what to watch for in the coming weeks.

With no fresh data, markets have shifted focus to Fed “Reserve commentary and this week the Federal Reserve governors and presidents will be making their rounds with a slew of speaking engagements”

Rate Movement

The Freddie Mac average 30-year fixed rate stood at 6.30% as of last Thursday, down 4 basis points compared to the prior week. That puts the max APR this week for 30-year fixed rate loans at roughly 7.80% (6.30 + 1.50). After showing declines for eight straight weeks, the index has hovered in the 6.30% range for the last three weeks. The 10-year Treasury yield closed last week at 4.06%, down 6 basis points for the week.

Economic and Fed Outlook

The major headline continues to be the partial government shutdown, which began at midnight on Wednesday, October 1. Now nearing its second week, the shutdown is sending ripple effects through the housing and capital markets as key economic data releases are delayed. Most notably, the September U.S. Employment Report—originally scheduled for release on October 3—has been postponed.

This week’s fresh inflation data, including the Producer Price Index and Import Price Index (Thursday and Friday), along with U.S. Retail Sales data (Thursday), could also be delayed depending on how long the shutdown persists. The odds of a prolonged shutdown increase each day as Congress remains gridlocked.

The next Federal Open Market Committee (FOMC) meeting is scheduled for the end of the month, and the lack of data could complicate the Fed’s rate decision. Despite the uncertainty, the bond markets are fully expecting a 0.25% rate cut on October 29. Should the shutdown continue, further delays in inflation and labor market data are likely, and mass federal worker furloughs could place additional pressure on an already weakening labor market.

Adding to the volatility, trade tensions escalated Friday when President Trump announced an additional 100% tariff on goods from China in response to what he called hostile export controls on rare earth minerals. The announcement triggered a stock market selloff and a modest bond rally, which could continue when markets reopen tomorrow.

This Week’s Schedule

With limited economic data available and continued uncertainty over fiscal policy, the fourth quarter begins with a cloudy outlook. In the absence of fresh data, market participants have turned their attention to Federal Reserve commentary, as several Fed governors and presidents deliver speeches this week.

If the shutdown ends soon, attention will quickly shift to the long-delayed September employment report and the next round of inflation data expected later this week and next.

Here’s to a steady and insightful week ahead as markets navigate uncertainty and await key economic signals to shape the next phase of monetary policy.