Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

Mortgage rates remain near their lowest levels since fall 2024, even after a slight uptick last week. Markets are shifting their focus back to the Federal Reserve as the January FOMC meeting concludes, with no rate cut expected but close attention on Chairman Powell’s comments for clues about future policy. Recent economic data shows the U.S. economy remains resilient, with steady growth and inflation holding near expectations. While global headlines and political discussions continue to influence market sentiment, the next realistic opportunity for a rate cut appears to be later this year, most likely around June, depending on how inflation and economic data trend in the coming months.

Here’s a look at this week’s update on major bond market indices, upcoming Federal Reserve activity, key economic data releases, and broader bond market trends.

Market Overview and Rate Trends

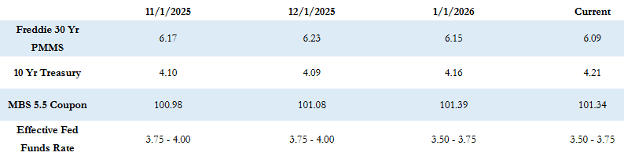

Mortgage rates have slowly and steadily moved downward since the end of November, and although they have drifted up slightly in the last week or so, they are currently at their lowest levels since September 2024. The Freddie Mac average 30-year fixed rate stood at 6.09% as of last Thursday, up slightly by three basis points compared to the prior week. Based on that average, the maximum APR this week for 30-year fixed-rate loans is roughly 7.59%.

The 10-Year Treasury yield closed last week at 4.24%, up one basis point on the week.

Global Events and Policy Headlines

Last week’s market headlines were dominated by developments coming out of the Davos World Economic Forum. Former President Trump continued to tease a proposed $200 billion MBS purchase plan, though few details have been provided regarding how such a plan would be implemented. While these purchases could help offset the Federal Reserve’s ongoing runoff of maturing MBS and potentially apply downward pressure on mortgage rates, most economists believe that housing supply constraints remain the primary driver of affordability challenges. As a result, MBS purchases alone are unlikely to provide significant relief to prospective homebuyers.

Also at Davos, Trump attempted to lower tensions surrounding Greenland, stating that he does not intend to use military force, and adopted a softer tone on potential new tariffs. These comments helped ease immediate fears of an escalating trade conflict with Europe.

Federal Reserve Focus Returns

Markets have recently shown heightened sensitivity to geopolitical headlines, including tensions in Iran, discussions surrounding Greenland, and trade dynamics with Europe. However, this week attention shifts back to monetary policy, with the Federal Reserve’s January FOMC meeting concluding on Wednesday.

Chairman Powell will hold his post-announcement press conference at 2:30 PM. A rate cut is fully priced out of the market for this meeting, and the Fed is expected to maintain its data-dependent stance.

Recent economic data continues to point to resilience in the U.S. economy. Q3 GDP came in slightly above expectations, while inflation remains subdued, with the PCE index meeting expectations at 2.8%. According to Fed Futures markets, the next realistic opportunity for a rate cut appears to be in June. Current probabilities suggest roughly a 15% chance of a 25-basis-point cut in March, increasing to 25% in April, and rising to approximately 50% by the June meeting.

It will be worth watching whether the FOMC statement or Chairman Powell’s comments signal any shift in policy strategy amid political pressure to ease rates sooner rather than later. Chairman Powell’s term is set to expire in May.

Economic Data to Watch This Week

Outside of the FOMC announcement, this week’s economic calendar is relatively light. Consumer confidence data will be released tomorrow, followed by the Producer Price Index (PPI) on Friday. Several Federal Reserve officials are also scheduled to speak later in the week.

Mortgage-backed securities prices are slightly higher by approximately five basis points compared to Friday’s close, while the 10-Year Treasury yield has eased a few basis points to 4.21%.

Looking Ahead

As we move through the final week of January, markets remain focused on Federal Reserve guidance, inflation trends, and broader global developments that could influence interest rate direction. We’ll continue to monitor these factors closely and share timely insights as conditions evolve.

Stay tuned as the data unfolds — the next update is right around the corner.