Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

Mortgage rates remain relatively stable near their lowest levels since fall 2024, even as markets react to shifting expectations around Federal Reserve policy. With new inflation and employment data scheduled for release this week, investors are closely monitoring economic signals that could influence bond market volatility. While the Federal Reserve continues to emphasize a data-dependent approach, market participants are recalibrating expectations for potential rate cuts later this year, particularly around the June and September meetings.

Here is this week’s update on the major bond market indices, scheduled Federal Reserve activity, upcoming market-moving economic data releases, and broader bond market trends.

“With both fresh inflation data and employment data being released this week, market participants will be busy dissecting the data and we could see some volatility in the bond markets.”

Market Overview and Rate Trends

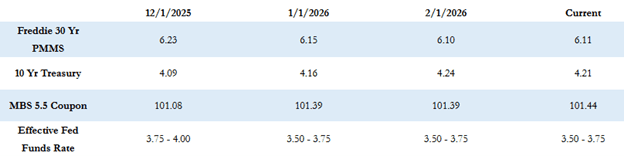

The Freddie Mac average 30-year fixed mortgage rate stood at 6.11% as of last Thursday, up slightly by one basis point compared to the prior week. Based on that average, the maximum APR this week for 30-year fixed-rate loans is roughly 7.61%.

The 10-Year Treasury yield closed last week at 4.21%, down three basis points for the week.

Mortgage rates have remained relatively unchanged over the past several weeks, with the Freddie Mac average 30-year fixed rate hovering near 6.10% for most of the year. While many in the industry expected rates to move lower by this point, current levels are still the lowest seen since fall 2024.

Late last week, signs of softening in the labor market triggered a sharp sell-off in equity markets, leading to a flight-to-quality rally in Treasuries. Mortgage-backed securities lagged Treasuries and did not experience the same level of price improvement.

Federal Reserve and Policy Outlook

Following the Federal Open Market Committee (FOMC) meeting at the end of January, Fed funds futures markets shifted away from expectations for multiple rate cuts in 2026. However, sentiment reversed last week, with markets once again pricing in potential rate cuts in June and September.

Currently, the probability of a 0.25% rate cut at both the June and September meetings stands at approximately 50%.

The Federal Reserve continues to emphasize a data-dependent approach, balancing labor market conditions against price stability as inflation remains above the Fed’s long-term target.

Economic Data and What to Watch

Last week’s January ADP employment report came in well below expectations, reigniting concerns about potential labor market weakness. This week brings additional employment data, including the official January U.S. Employment Report, expected on Wednesday after being delayed due to the partial government shutdown.

Inflation data will also be in focus, with the Import Price Index scheduled for Tuesday and the January CPI report set for release on Friday. In addition, numerous Federal Reserve speaking engagements are on the calendar, and any public commentary regarding policy strategy could influence market sentiment.

Current Market Conditions

Mortgage-backed securities prices are essentially flat compared to Friday’s close, and the 10-Year Treasury yield remains steady at 4.21%.

Looking Ahead

With key inflation and employment reports scheduled for release and ongoing Federal Reserve commentary, near-term market volatility remains possible. Staying informed and prepared will be essential as investors and industry participants navigate evolving economic conditions.

Wishing you a productive week ahead as markets continue to evolve.