Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways

Mortgage rates remain near their lowest levels since late 2024, even as economic data continues to shift market expectations around Federal Reserve policy. Strong employment data and moderating inflation readings have created mixed signals for bond markets, while investors closely watch upcoming Federal Reserve minutes, GDP data, and inflation reports for clues on the path of interest rates in 2026.

Here is this week’s update on the major bond market indices, scheduled Federal Reserve activity, upcoming market-moving economic data releases, and broader bond market trends.

“On Wednesday the minutes from the January FOMC meeting will be released so it’ll be interesting to hear what went into the Fed’s decision to hold rates steady at their last meeting, and what their consensus is for rate decisions at their upcoming meetings.”

Market Overview and Rate Trends

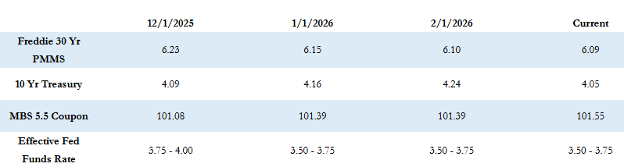

The Freddie Mac average 30-year fixed mortgage rate stood at 6.09% as of last Thursday, down slightly by two basis points compared to the prior week. Based on that average, the maximum APR this week for 30-year fixed-rate loans is roughly 7.59%.

The 10-Year Treasury yield closed last week at 4.05%, down sharply by 16 basis points for the week.

Mortgage rates have not changed significantly over the past several weeks, with the Freddie Mac average 30-year fixed rate hovering around 6.10% for most of this year. These levels remain the lowest seen since late 2024.

Last week, the January payrolls report was released and came in much stronger than expected. The report showed 130,000 jobs created versus the expectation of 55,000, and the unemployment rate came in at 4.3%, slightly below the 4.4% expectation. The strong employment numbers reduced the probability of any Federal Reserve rate cuts in the first half of the year, with the odds of a 0.25% cut by June now slightly below 50%.

The bond market initially sold off following the strong employment data. However, the January Consumer Price Index was also released last week and showed inflation coming in slightly lower than expectations at 2.4%. In addition, concerns around tech company profits sparked a stock market sell-off, which led to a rally in the bond markets on Friday.

Mortgage-backed securities lagged Treasuries and did not rally as strongly, but mortgage rates continue to remain near their lowest levels since late 2024.

Federal Reserve and Policy Outlook

After Monday’s bond market holiday, this week’s economic calendar is especially busy.

On Wednesday, the minutes from the January FOMC meeting will be released. Investors will closely review the details behind the Fed’s decision to hold rates steady and look for insight into consensus expectations for upcoming meetings.

The Federal Reserve continues to emphasize a data-dependent approach, balancing strong labor market conditions against inflation trends that remain above the long-term target.

Economic Data and What to Watch

This week includes several housing-related reports, including housing starts, building permits, and new home sales.

On Friday, the fourth-quarter GDP report will be released along with personal income and spending data. If economic growth continues to exceed expectations, we could see rates move modestly higher.

The Personal Consumption Expenditures (PCE) index, the Fed’s preferred gauge of inflation, will also be released Friday. If inflation remains persistent, it may push potential rate cuts further out this year. However, continued easing in inflation data would strengthen the case for cuts sooner rather than later.

Current Market Conditions

MBS prices are essentially flat compared to Friday’s close, and the 10-Year Treasury yield is down a few basis points to approximately 4.03%.

Looking Ahead

With key Federal Reserve communications and major economic reports scheduled this week, markets could experience increased volatility as investors reassess expectations for rate policy in 2026. Staying informed and prepared will be critical as economic data continues to shape the path of mortgage rates in the months ahead.

Wishing you a productive and successful week as we continue to monitor the evolving capital markets landscape.