Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

“Mortgage rates have been volatile, driven largely by uncertainty around new U.S. tariff policies and their potential economic impacts. While market data releases are light this week, upcoming Fed speeches could significantly influence market direction.”

Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

“The new tariff policy coming from the Trump Administration has caused much volatility in the financial markets over the past few weeks. Trade policy has taken center stage, overshadowing economic data releases as the primary market driver.”

Market Overview

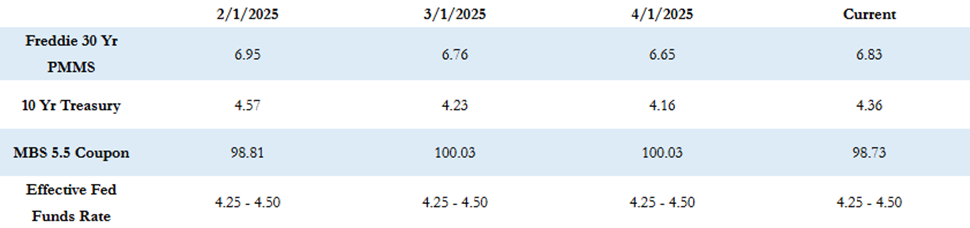

For the past six weeks, we have seen mortgage rates fluctuate wildly, but the Freddie index is only published once a week, so it had only moved up or down by a few basis points despite much larger moves intra-week. However, we finally saw a big spike in the index up to 6.83% this week. That puts the max APR this week for 30-year fixed-rate loans at roughly 8.33% (6.83 + 1.50).

Despite the spike last week and the extreme volatility, the average 30-year rate has been below 7% since mid-January. The 10-year Treasury yield was also very volatile last week and closed the week at 4.33%, which was a decrease of 16 basis points for the week.

Tariffs

The new tariff policy coming from the Trump Administration has caused much volatility in the financial markets over the past few weeks. Trade policy has taken center stage, overshadowing economic data releases as the primary market driver.

The new tariff policies went into effect earlier in the month on 4/2 and were then paused for 90 days for all countries except for China on 4/9. The uncertainty around the impact of the tariffs on the U.S. economy and inflation, and also the uncertainty around the implementation of the tariffs, has driven volatility higher over the past week.

Fed Chairman Powell has said that the tariffs could lead to both higher inflation and weaker economic conditions in the U.S. However, there’s very little clarity on the actual impact that the tariffs will have on employment and inflation, so the Fed will maintain a very cautious approach and will remain dependent on new economic data.

The wild moves that we are seeing in the markets are not based on any fundamental analysis of the impact of the tariffs. The volatility is due to the uncertainty around the tariffs and the uncertainty about Fed policy due to the tariffs. The Fed faced criticism from the White House over the weekend after Powell sounded the alarm on growth and inflation risks due to tariffs. Powell’s concerns are around potential scenarios playing out where it will be difficult for the Fed to balance inflation and support growth at the same time due to the impact of tariffs.

The initial effects on the market from the tariff announcements have settled somewhat, and the focus should shift to the actual economic impact of the policy. Because of lags in the data, most recent releases haven’t shown the impact of the tariffs. However, going forward, new economic data releases will be analyzed carefully for insight into the impact of the tariffs.

Although this week is fairly light in terms of new market-moving data, there will be fresh housing data released on Wednesday and Thursday, and Consumer Sentiment will be released on Friday.

The biggest potential market-moving events this week will be Fed presidents’ speaking engagements. Eight Fed presidents will be making speeches at various events between Tuesday and Thursday. Given the recent market volatility and the criticism of Fed policy coming from the Trump Administration, it will be interesting to hear what the Fed presidents have to say—and their comments definitely have potential to move the markets.

So far today, rates are on the rise again. The 10-year is up sharply by about 3 basis points to 4.36%, and MBS prices are worse by 15–20 basis points compared to where they closed on Friday. Volatility will remain elevated in the bond and stock markets this week, as participants digest new data and continue to assess the impact of the new tariffs.

Stay tuned for next week’s market update!