Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

“Bond markets remain volatile as new tariffs create uncertainty around inflation and economic growth, prompting the Federal Reserve to stay cautious about cutting rates. This week, key economic reports like GDP and employment data will help markets better understand how trade policies are impacting the economy.”

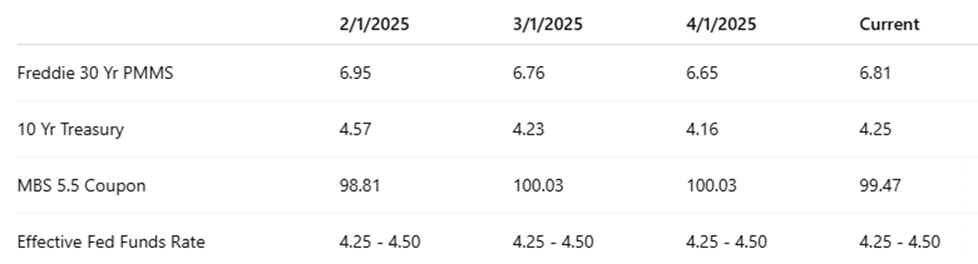

Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

“There’s very little clarity on the actual impact that the tariffs will have on employment and inflation, so the Fed will maintain a very cautious approach and will remain dependent on new economic data.”

Rate Trends

The Freddie Mac average 30-year fixed rate is at 6.81% as of last Thursday, down by 2 basis points from the prior week. That puts the max APR this week for 30-year fixed-rate loans at roughly 8.31% (6.81 + 1.50). Despite recent increases in rates and the extreme volatility, the average 30-year rate has been below 7% since mid-January. The 10-year Treasury yield has also been very volatile and closed the week at 4.27%, a decrease of 6 basis points for the week.

Market Volatility and Tariff Impact

The new tariff policy coming from the Trump Administration has caused much volatility in the financial markets over the past few weeks, but there was some calming in the markets last week. Volatility eased, but the uncertainty around the effects of tariffs remains. Trade policy has taken center stage, overshadowing economic data releases as the primary market driver. Fed Chairman Powell has said that the tariffs could lead to both higher inflation and weaker economic conditions in the U.S. However, there’s very little clarity on the actual impact that the tariffs will have on employment and inflation, so the Fed will maintain a very cautious approach and will remain dependent on new economic data.

Political Pressure on the Fed

The Fed has faced criticism from the White House after Powell sounded the alarm on growth and inflation risks due to tariffs. President Trump has attacked Powell and is essentially blaming him for a pending economic slowdown after leaving rates too high for too long. It’s worth noting that the president can’t fire the Fed Chairman and the Fed is — and should remain — independent from the political sphere.

Given that, the FOMC will probably ignore the attacks, but if there is any reaction by the Fed as a whole, it most likely will be to wait just a little longer before cutting rates. They continue to emphasize the inflation risk due to the tariffs, and now, with such clear political pressure to cut rates, they cannot reverse themselves now and signal that they caved to the pressure. The chances of a rate cut coming at the May FOMC meeting have dwindled and are less than 10% now, but the chances of a cut in June continue to increase and are closer to 75%.

Economic Data to Watch This Week

The initial effects on the market from the tariff announcements have settled somewhat, and the focus should shift to the actual economic impacts of the policy. This week, the economic calendar is very busy with fresh key data releases. The first look at 2025 Q1 GDP will be out on Wednesday, along with the ADP employment report. Also on Wednesday, the PCE Index for March will be released — and that report is the Fed’s preferred gauge of inflation — so it has the potential to move the market. Then, on Friday, the official March U.S. employment report will be released.

With such a heavy week of data releases, we should see the markets return to more fundamental analysis of the economic data to gain clarity on the impact of tariffs on the economy and how that fits into the Fed’s overall strategy of price stability and full employment.

Current Market Movements

So far today, MBS prices are better by about 10–15 basis points compared to Friday’s close, and the 10-year is down by about 4 basis points to 4.22%. Volatility will remain elevated in the bond and stock markets this week, but as fresh new data is released, the markets should begin to gain some clarity on the effects of trade policy.

Stay tuned for next week’s market update!