Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers

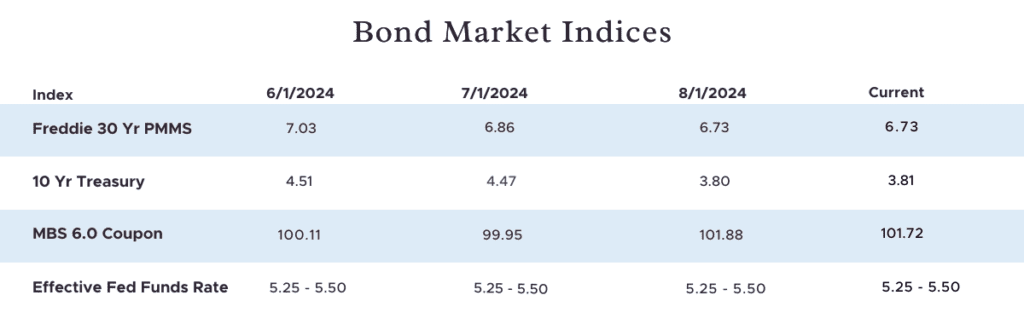

I hope everyone enjoyed the weekend! Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

“As expected, the Fed held its benchmark Fed Funds target rate steady at their July 31st decision meeting last week, and the FOMC did slightly change its policy statement to include that they do think that a rate cut will likely be appropriate soon.”

As expected, the Fed held its benchmark Fed Funds target rate steady at their July 31st decision meeting last week, and the FOMC did slightly change its policy statement to include that they do think that a rate cut will likely be appropriate soon. The bond markets rallied on the news, and the 10-year Treasury dropped sharply below 4% for the first time in 6 months. The market expectation has shifted to an almost 100% certainty of a 25 basis point rate cut in September! In prior meetings, the Fed’s concern was on lingering elevated inflation, which has since shifted to a downtrend. The Fed seems more concerned now with weakness in the economy and cited recent GDP data not signaling weakness. This was a bit counterintuitive because if the economy is not showing weakness, then why is the Fed likely ready to cut rates now? That became a moot point after Friday’s terrible July nonfarm payrolls report. The July jobs number came in at 114,000 and was well below the market expectation of 185,000, and the unemployment rate shot up to 4.3%, above the expectation of 4.1%. With recent favorable inflation data and signs of a weakening economy in the employment data, the current question is not if the Fed will cut rates in September, but by how much. It should be noted that the Fed remains very data-dependent, and they will continue to monitor data leading up to their next meeting in September, and if they see a reversal of recent trends, then they may take a September rate cut off the table.

Rate cut expectations have increased significantly with the fed funds futures market now seeing about a 75% implied likelihood of a 50 basis point rate cut in September, up from 22 percent before the report and 11 percent at the beginning of last week. Some economists are now projecting three rate cuts before the end of the year. However, all of that is dependent on fresh data.

Economic Indicators and Future Outlook

This week’s economic calendar is much lighter than last week. There is very little in terms of market-moving economic data releases, but we have the US Trade Deficit report tomorrow, Consumer Credit on Wednesday, and weekly jobless claims on Thursday. Also, various Fed speakers are making the rounds this week, coming off of last week’s policy statement.

So far today, MBS prices are down by about 15-20 basis points compared to Friday’s close, and the strong rally from last Thursday and Friday has fizzled out. The 10-year Treasury is basically flat compared to Friday’s close at 3.80%.

Have a great week!