Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

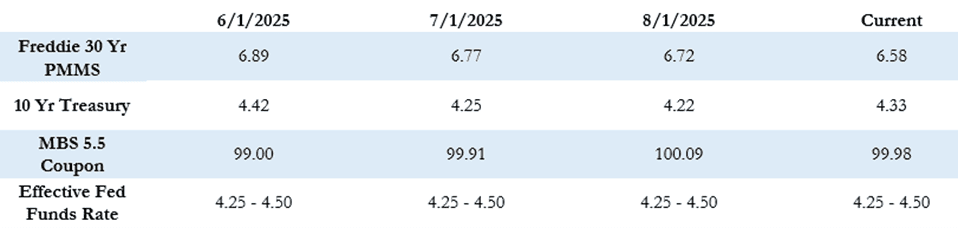

This week’s mortgage market update shows the 30-year fixed mortgage rate dropping to 6.58%, while the 10-year Treasury yield edged up to 4.33%. Despite mixed economic signals, the market expects a 0.25% Federal Reserve rate cut in September, which could impact mortgage rates and refinancing opportunities. Homebuyers and investors should watch upcoming inflation reports and Fed updates, as these will help shape the housing and mortgage market in the weeks ahead.

Let’s take a look at the latest trends, rate movements, and what to watch for in the coming weeks.

“Despite the renewed inflation worries, the MBS market held flat last week, and the market still believes a rate cut is coming at the September FOMC meeting. The odds for a .25% rate cut in September is currently right around 90%”

Rate Movement

The Freddie Mac average 30-year fixed rate is at 6.58% as of last Thursday, down by 5 basis points compared to the prior week. That puts the max APR this week for 30-year fixed rate loans at roughly 8.08% (6.58 + 1.50). The index has seen declines for four straight weeks and has broken below 6.60% for the first time since October of last year. The 10-year Treasury yield closed last week at 4.33%, up by 5 basis points for the week.

Economic and Fed Outlook

Last week was a relatively quiet week for the MBS market despite more mixed economic signals in the data releases. July headline CPI came in right on expectations, but core CPI came in higher than expected. Then on Thursday, the PPI came in surprisingly high, almost double expectations. The data renewed fears about inflation just as the markets were shifting focus to the employment outlook.

Despite the renewed inflation worries, the MBS market held flat last week, and the market still believes a rate cut is coming at the September FOMC meeting. The odds for a .25% rate cut in September is currently right around 90%. Recent payroll reports have provided evidence that the labor market is cooling, and most economists believe the Fed will continue to prioritize the employment outlook over inflation concerns.

Looking Ahead to the FOMC Meeting

Between now and the FOMC meeting on September 18, we’ll see plenty more data releases that could shift the Fed’s stance and provide the justification they need to finally resume rate cuts. The FOMC has always had a tendency toward caution, especially after several meetings with no change in policy. Historically, when they shift from an unchanged stance to a cut or hike, the committee often moves later than what would be considered optimal. However, it appears they may be getting close to that elusive shift in policy. Longer term, rates are expected to continue a gradual downward trend through the rest of the year and into 2026.

This Week’s Economic and Fed Schedule

We’ll see the minutes from the July FOMC meeting released mid-week, but otherwise, this week is fairly light on new economic data. There are scheduled Fed speaking engagements throughout the week, including Chairman Powell speaking on Friday at the FOMC’s Jackson Hole Symposium. So far today, MBS prices are generally flat compared to where they closed on Friday, and the 10-year Treasury is also flat at 4.33%.

We’ll continue to monitor the markets closely and provide updates as the data and Fed commentary unfold in the weeks ahead.