Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

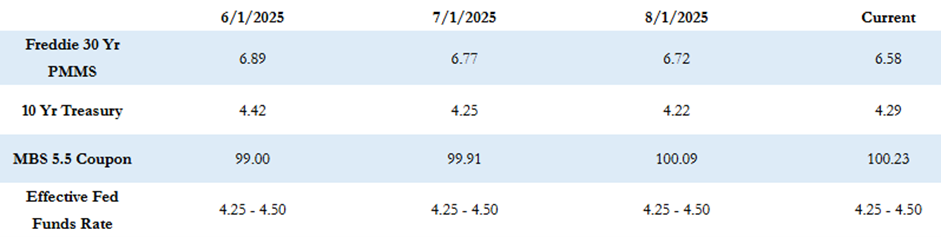

Mortgage rates fell again last week, with the Freddie Mac 30-year fixed average dropping to 6.58%—the lowest since October and the fifth straight weekly decline. The 10-year Treasury yield eased to 4.26%. Markets rallied after Fed Chair Jerome Powell signaled a more dovish stance at Jackson Hole, pushing odds of a September rate cut above 90%. This week, all eyes are on key housing reports, Q2 GDP, consumer spending, and the Fed’s preferred inflation gauge, the PCE Index

Let’s take a look at the latest trends, rate movements, and what to watch for in the coming weeks.

“Powell’s dovish pivot was seen as opening the door to rate cuts as early as next month”

Rate Movement

The Freddie Mac average 30-year fixed rate is at 6.58% as of last Thursday and was unchanged compared to the prior week. That puts the max APR this week for 30-year fixed rate loans at roughly 8.08% (6.58 + 1.50).

The index has now seen declines for five straight weeks and broke below 6.60% for the first time since October of last year. The 10-year Treasury yield closed last week at 4.26%, which was down by 7 basis points.

Economic and Fed Outlook

Last week the minutes from the July FOMC meeting were released and showed that the Fed remains cautious about inflation, viewing price pressures as the greater risk compared to labor market weakness. Only two governors favored a rate cut in July.

However, Chairman Powell’s Jackson Hole speech surprised markets with a more dovish tone. Powell stated, “the shifting balance of risks may warrant adjusting our policy stance,” sparking a rally in the bond market and pushing market-implied odds of a September rate cut to over 90%.

Powell emphasized that the current policy rate is significantly closer to neutral than it was a year ago and reiterated the importance of anchored inflation expectations in the Fed’s strategy. His remarks set a constructive tone for upcoming policy discussions, and more commentary is expected from other Fed officials this week, which will be closely watched to see if they adopt his dovish stance.

This Week’s Schedule

The economic calendar is busy ahead of the holiday weekend. Housing data will be in focus, with reports on new and pending home sales as well as the Case Shiller home price index. In addition, Q2 GDP, personal income and spending, and the PCE Index (the Fed’s preferred gauge of inflation) will all be released.

So far today, MBS prices are slightly worse than Friday’s close, and the 10-year Treasury yield is up a few basis points to 4.28%.

We’ll continue to monitor the markets closely and provide updates as the data and Fed commentary unfold in the weeks ahead.

Have a great week!