Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

The bond market rallied last week following a weaker-than-expected jobs report, increasing optimism that the Federal Reserve may finally begin cutting rates in September. Meanwhile, inflation data remains sticky, keeping the Fed cautious. Mortgage rates continue to hover near the bottom of their recent range, offering a bit of stability for borrowers.

Let’s take a look at the latest trends, rate movements, and what to watch for in the days ahead.

“Between now and the FOMC meeting on 9/18 we’ll see plenty of data releases that could shift the Fed’s stance and provide the justification that they need to finally resume rate cuts.”

Market Rate Observations

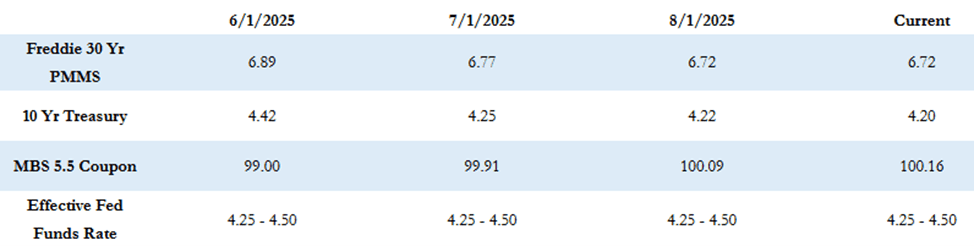

The Freddie Mac average 30 year fixed rate is at 6.72% as of last Thursday, and was down by 2 basis points compared to the prior week. That puts the max APR this week for 30 year fixed rate loans at roughly 8.22% (6.72 + 1.50). The index has been in the 6.70-6.90% range since mid-April and remains at the lower end of that range now. The 10 year Treasury yield closed last week at 4.20% which was down sharply by 16 basis points for the week.

Fed Outlook and Mixed Economic Signals

Last week was very busy in terms of economic data and Fed news. The Fed has been digesting mixed data and signals, and has faced political pressure to cut rates sooner rather than later. However, as expected the FOMC held rates steady last week at their July meeting. Inflationary pressure from tariff policy has begun to show up in the data. Last week June’s core PCE index rose .3% month over month which was one of the largest monthly gains this year. Chairman Powell has maintained his hawkish stance and stated that he does not believe that the economy is currently constrained by the Fed’s policy. However, on Friday the July non-farm payrolls report came in at 73,000 which was far below the expectation of 100,000. In addition, there was a large downward revision of 258,000 jobs over the prior two months. The employment data suggests that the economy is being constrained by Fed policy but when combined with the inflation data the FOMC feels that the picture is still murky and the data is mixed. The bond markets rallied on Friday after the weakness in the employment report and optimism for a rate cut in September has increased sharply. The current odds of a .25 cut in September are at 85%, up very sharply for the week.

Looking Ahead

Between now and the FOMC meeting on 9/18 we’ll see plenty of data releases that could shift the Fed’s stance and provide the justification that they need to finally resume rate cuts. The FOMC has always had a tendency towards caution, especially after a number of meetings with no change in policy. Historically, when they shift from an unchanged stance, to a cut or hike, the committee shifts policy later than what would be considered optimal more often than not. However, it appears that they may be getting close to that elusive shift in policy.

This week is very light on data and there are no market moving releases expected. So far today, the rally from Friday is continuing and MBS prices are better by about 10-15 basis points from where they closed on Friday, and the 10 year Treasury is down a few more basis points to 4.20%.

We’ll continue tracking all key developments—stay tuned and have a great week!