Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

Last week, the bond market was steady after a busy few months. Mortgage rates have stopped rising for now, staying at their highest levels since July. The Fed is expected to lower rates again this month to help with inflation, aiming for a 2% goal. There’s also a lot of focus on new job data coming out this week, which could impact rates and the economy. Overall, things are calming down a bit, but big decisions are still ahead!

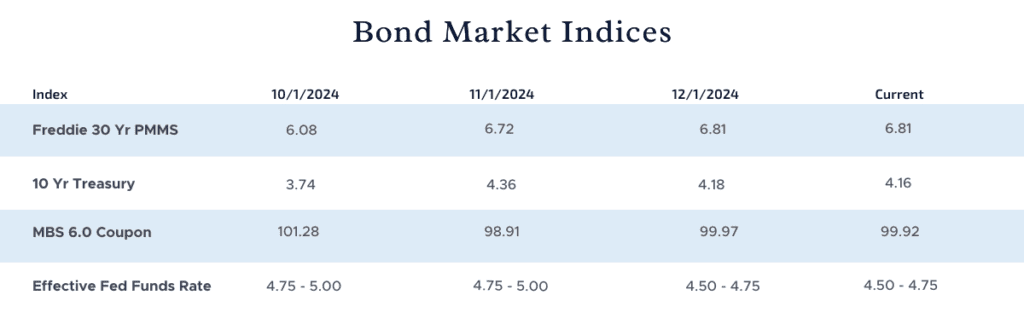

This week, we’re diving into the latest updates on bond market indices, key Federal Reserve meetings, and the economic data releases that could shake up the markets. Let’s explore the trends shaping the financial landscape right now.

“The Fed has expressed confidence that inflation is moving sustainably toward its 2% goal, and all recent public statements suggest that we are in for another 25 basis point cut later this month.”

Market Overview

Despite the shortened trading week, there was an abundance of data releases focused on the U.S. consumer and inflation. Key highlights:

- Q3 GDP: Remained unchanged from prior estimates.

- PCE Inflation Index: Met expectations.

With no major surprises in the data, rates remained relatively flat compared to the prior week. Although mortgage rates had been rising for seven consecutive weeks, they have leveled off over the past two weeks. However, rates remain at their highest levels since July.

Federal Reserve Update

At the beginning of the year, it was widely anticipated that the Fed would begin cutting rates before summer, with an expectation of 150 basis points of cuts by year-end. However, the first rate cut didn’t arrive until September, and there have been only 75 basis points of total reductions so far.

The Fed is still expected to implement another 25 basis point cut in December. Recent sentiment reflects the Fed’s cautious approach, emphasizing data dependence and flexibility in its decisions. The Fed’s confidence in inflation nearing its 2% goal suggests a steady path forward.

At the FOMC meeting on December 18th, the Fed will publish forecasts for key economic indicators and the federal funds rate for the next three years, providing more clarity on 2025 policy direction.

This Week’s Focus

This week’s spotlight is on employment data:

- Wednesday: ADP Employment Report.

- Friday: Official U.S. November Employment Report.

Additionally, several Fed officials are scheduled to speak throughout the week. So far today, MBS prices remain flat compared to yesterday’s close, while the 10-year Treasury is up a few basis points at 4.19%.

Stay tuned as we monitor the market for any changes—come back next week for the newest updates and insights!