Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

Mortgage rates remain near their lowest levels since fall 2024, despite a slight uptick over the past week. The Federal Reserve held its benchmark rate steady at its most recent meeting, signaling patience as inflation remains above its 2% target and labor market data continues to guide future policy decisions. Market expectations for near-term rate cuts have diminished, with June now viewed as the earliest realistic opportunity. This week, attention will be focused on upcoming employment data and developments in Washington, both of which could influence bond market movement and interest rate trends.

Here is this week’s update on the major bond market indices, scheduled Federal Reserve activity, upcoming market-moving economic data releases, and broader bond market trends.

“The other big headline aside from the FOMC and market data was President Trump’s announcement that he intends to nominate former Fed Governor Kevin Warsh to succeed Powell as the Federal Reserve Chairman.”

Market Overview and Rate Trends

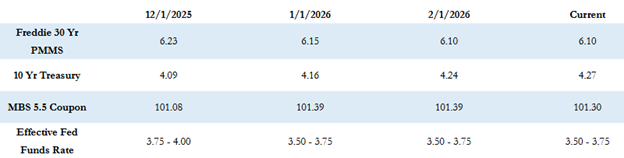

The Freddie Mac average 30-year fixed mortgage rate stood at 6.10% as of last Thursday, up slightly by one basis point compared to the prior week. Based on that average, the maximum APR this week for 30-year fixed-rate loans is roughly 7.60%.

The 10-Year Treasury yield closed last week at 4.24%, remaining flat for the week.

Mortgage rates have slowly and steadily moved downward since the end of November, and although they have drifted up slightly in the last week or so, they remain at their lowest levels since September 2024.

Federal Reserve Update

As expected, the Federal Open Market Committee (FOMC) held its benchmark Fed Funds Rate steady in the 3.50%–3.75% range at last week’s meeting. The decision was not unanimous, with two committee members dissenting in favor of a 0.25% rate cut.

Overall, the FOMC made no significant changes to its policy stance. Based on comments from the post-announcement press conference, the committee appears comfortable with where rates are currently set and sees little urgency to cut rates further at this time. Chairman Powell reiterated the need for patience and data dependency, with continued focus on labor market conditions while inflation remains above the Fed’s 2% target.

Since the announcement, expectations for intermediate-term rate cuts have declined. According to Fed Futures markets, the next realistic opportunity for a rate cut appears to be in June. The odds of a 0.25% cut are approximately 10% in March, 20% in April, and increase to about 50% for the June meeting.

Economic Data and Political Developments

Aside from the FOMC announcement, last week’s economic calendar was relatively light. However, the Producer Price Index (PPI), a key gauge of inflation, came in slightly higher than expectations on Friday.

Another major headline was President Trump’s announcement that he intends to nominate former Federal Reserve Governor Kevin Warsh to succeed Jerome Powell as Federal Reserve Chairman. Warsh is well known on Wall Street and is generally viewed as more hawkish than Powell. That said, most economists do not expect an immediate or dramatic shift in monetary policy and instead anticipate continuity with the Fed’s current data-dependent approach.

What to Watch This Week

This week’s focus will turn to fresh labor market data, with the ADP employment report scheduled for Wednesday, followed by the January U.S. Employment Report on Friday. Attention will also remain on Congress as lawmakers work to resolve another partial government shutdown that began over the weekend.

Mortgage-backed securities prices are down approximately 10–15 basis points compared to Friday’s close, while the 10-Year Treasury yield has moved up a few basis points to 4.27%.

Looking Ahead

As markets digest economic data, Federal Reserve guidance, and political developments, volatility may persist in the near term. Staying informed and prepared remains critical as conditions continue to evolve.

Stay connected for our weekly market insights and expert analysis to help you navigate changing economic conditions with confidence.