Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

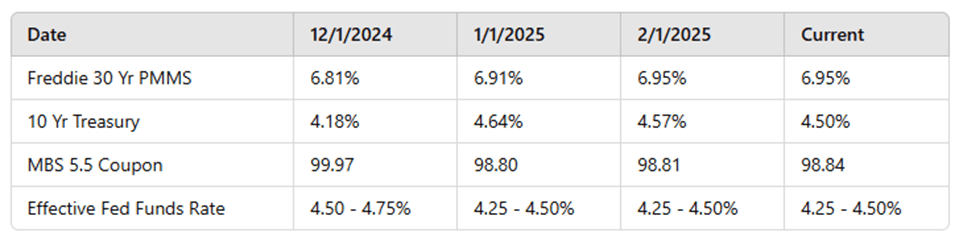

Mortgage rates have remained steady, with the 30-year fixed rate holding at 6.95% and the 10-year Treasury yield slightly decreasing to 4.50%. The Federal Reserve kept rates unchanged, citing steady economic growth and lingering inflation concerns, while the market awaits key employment data that could influence future rate decisions.

Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

“In his press conference after the interest rate decision, Chairman Powell stated that, given current economic conditions, the Federal Reserve is in no hurry to adjust the Fed Funds Rate.”

Federal Reserve & Economic Data

As expected, the Federal Reserve left its benchmark rate unchanged last week at its first FOMC meeting of the year. Economic data continues to indicate that the U.S. economy is expanding at a healthy pace.

- The Q4 2024 GDP report, released Thursday, came in slightly below expectations but remained strong.

- The PCE inflation index, the Fed’s preferred inflation gauge, showed inflation still above the 2% target.

During his press conference, Chairman Powell reaffirmed that the Fed is in no rush to adjust rates. In addition to current economic data, the changing fiscal landscape under the new administration remains a key factor. The Fed will closely watch how new Trump-era tariffs impact consumer prices.

Looking Ahead: Key Economic Data This Week

- Wednesday: ADP Employment Report

- Friday: Official U.S. Employment Report

Aside from the employment reports, the week is light on economic data. However, expect various Federal Reserve officials to make public statements throughout the week.

So far today, MBS prices are rallying, up 20-25 basis points, while the 10-year Treasury yield has dropped 6 basis points to 4.50%.

Final Thoughts

With mortgage rates relatively unchanged in recent weeks, the market continues to reflect the Fed’s cautious, wait-and-see stance. We’ll be watching employment data closely this week for further market direction.

We’ll keep an eye on the market—check back next week for updates. If you want to talk about your homeownership goals, reach out anytime. We’re here to help!