Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

Mortgage rates continue to trend lower as markets assess Federal Reserve policy direction, evolving labor market conditions, and fresh inflation data. Recent bond market activity suggests cautious optimism, with rates hovering near multi-year lows. As investors digest new economic releases and policy signals, attention remains firmly on inflation trends and future Fed action as we move deeper into 2026.

Let’s take a closer look at the factors shaping the mortgage and bond markets as the year begins.

“Rates have slowly and steadily moved downward since the end of November, and as of last week average 30-year rates have reached their lowest levels in about 2 years!”

Rate Trends and Market Drivers

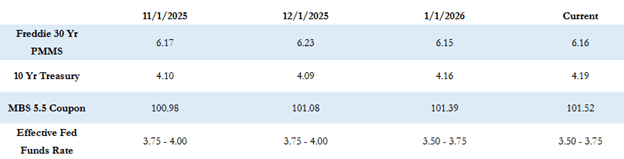

Mortgage rates have continued a gradual downward trend since late November, with the Freddie Mac average 30-year fixed rate ending last week at 6.16%, essentially unchanged from the prior week. This places average rates at their lowest levels in roughly two years, offering some relief amid ongoing affordability challenges.

The 10-Year Treasury yield closed last week near 4.17%, down modestly on the week, reflecting cautious investor positioning ahead of upcoming economic data and Federal Reserve commentary.

The most notable economic release last week was the December employment report, which showed signs of softening in the labor market. Job openings declined to a one-year low, and job growth came in below expectations. Continued labor market cooling could increase the likelihood of additional Fed rate cuts later this year, though expectations for action at the Fed’s January 28th meeting remain low. Market focus has shifted toward the March meeting, where the probability of a rate cut is currently higher.

Policy Developments and Market Impact

Late last week, President Trump instructed Fannie Mae and Freddie Mac to purchase up to $200 billion in mortgage-backed securities using available balance sheet cash. When agencies or the Federal Reserve purchase MBS, it increases demand, which can support higher prices and lower mortgage rates. While FHFA leadership has indicated alignment with this directive, implementation details remain unclear.

While MBS purchases alone do not guarantee sustained declines in mortgage rates—particularly given ongoing housing supply constraints—this move underscores continued efforts to support housing affordability and mortgage market stability.

President Trump has also continued to publicly pressure Federal Reserve Chair Jerome Powell to accelerate rate cuts. Powell has pushed back firmly, reiterating the Fed’s commitment to making policy decisions based on economic data rather than political influence. With Powell’s term set to expire in May, speculation remains around potential leadership changes and their implications for future monetary policy.

Economic Data Ahead

This week brings a busy economic calendar, highlighted by the release of December inflation data. The Consumer Price Index (CPI) and Producer Price Index (PPI) reports scheduled for Tuesday and Wednesday will be closely watched for confirmation that inflation continues to moderate. While these releases are unlikely to alter expectations for January, they could influence sentiment around potential rate cuts later in the first quarter.

In addition, multiple Federal Reserve officials are scheduled to speak this week, with messaging expected to reinforce a patient, data-dependent approach. Clearer evidence of sustained labor market weakness, rather than short-term inflation fluctuations, will likely be required to justify further easing.

Current Market Conditions

Currently, mortgage-backed securities prices are modestly higher by approximately 5 basis points compared to Friday’s close, while the 10-Year Treasury yield is trading near 4.19%.

Looking Ahead

As the year unfolds, markets remain focused on incoming inflation data, labor market signals, and Federal Reserve guidance. While recent trends suggest improving conditions for mortgage rates, volatility remains possible as policy expectations continue to evolve. We’ll continue monitoring these developments closely and provide timely insights on what they may mean for the mortgage and housing markets in the weeks ahead.

With more key economic data on the horizon, we’ll continue tracking how shifting conditions may influence rates and the housing market—our next update is coming soon.