Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

Interest rates and the bond market have been impacting mortgage rates, making it challenging for homeowners to secure lower loan rates. With key economic reports and Federal Reserve updates on the horizon, staying informed on these developments is essential for understanding potential changes in the market.

Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

“There has been a significant shift in expectations over the last few months, driven by concerns about persistent inflation and a stronger-than-expected labor market. Fed Funds futures markets are now forecasting just one rate cut this year, with only a small chance of multiple cuts remaining.”

Mortgage Rates and Market Trends

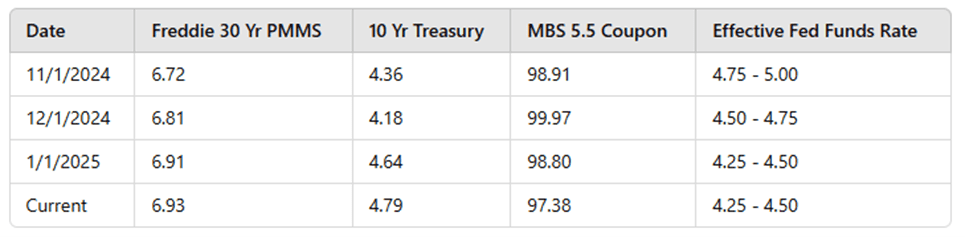

The Federal Reserve has cut its benchmark rate by 100 basis points since September 18th. However, this reduction in the Fed Funds Rate has not been reflected in mortgage rates, which have continued to rise through the end of 2024 and into 2025. Since the Fed began cutting, mortgage rates for conventional, FHA, and VA loans have all increased.

Hotter-than-expected jobs data was released on Friday, with non-farm payrolls rising by 256,000 versus the expected 155,000. Bond yields and mortgage rates moved higher, with the 10-year Treasury reaching highs not seen since November 2023, around 4.80%. Globally, yields are moving higher, with many market participants anticipating a slowdown in the pace of rate cuts this year, as the Fed remains cautious amid signs of economic strength mixed with potential policy changes as Trump takes office. The shift in expectations over the last few months has been driven by concerns about persistent inflation and a stronger-than-expected labor market. Fed Funds futures markets are now forecasting just one rate cut this year, with only a small chance of multiple cuts remaining.

What to Expect This Week

This week brings a fresh round of inflation data, with the PPI being released on Tuesday and the CPI on Wednesday. Recent data suggests that inflation is rising again, so it will be interesting to see if this week’s releases continue that trend. Housing data is also scheduled for later this week, with the latest home builder confidence index, housing starts, and building permits being released on Thursday and Friday. Additionally, several Fed speaking engagements this week could generate market-moving headlines. So far today, MBS prices are down slightly by about 10-15 basis points, and the 10-year Treasury is generally flat at 4.79%.

We’ll continue to monitor the market for any changes—be sure to check back next week for our latest updates and insights.