Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

Mortgage rates continue to hover near multi-year lows as financial markets weigh Federal Reserve policy, inflation trends, and broader economic and geopolitical developments. While recent data presents a mixed picture, bond markets have remained relatively stable, and mortgage pricing continues to benefit from supportive market conditions

Let’s take a closer look at the factors shaping the mortgage and bond markets as the year begins.

“It’s expected that the Fed will hold rates steady at the end of January but the focus will shift to their March meeting where current odds of a .25% rate cut are about 25%.”

Mortgage Rate Trends

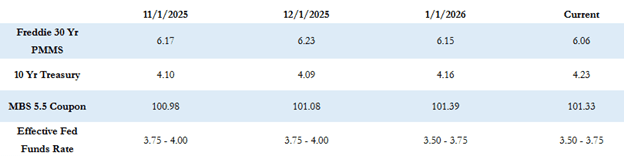

The Freddie Mac average 30-year fixed mortgage rate fell sharply last week, ending at 6.06%, a 10-basis-point improvement from the prior week and the lowest level in roughly three years. Based on current pricing, this places the estimated maximum APR for 30-year fixed-rate loans at approximately 7.56%.

While rates drifted slightly higher late Friday, the broader trend remains favorable as investors continue to respond to economic data and policy signals.

Federal Reserve Outlook

Economic indicators remain mixed. The labor market has shown resilience, with jobless claims coming in stronger than expected, while inflation data has largely aligned with expectations or cooled modestly. This combination supports the Federal Reserve’s patient approach to rate adjustments.

At this point, a rate cut at the January 28th Fed meeting is highly unlikely. Instead, market attention has shifted to the March meeting, where current expectations point to a roughly 25% chance of a quarter-point rate cut.

Policy, Geopolitics, and Market Stability

Markets are also digesting a range of global and domestic developments, including geopolitical tensions abroad, political pressure on the Federal Reserve, and recent Supreme Court rulings related to tariff risks. Despite these factors, bond markets have remained relatively calm, with no significant flight-to-quality behavior.

In addition, President Trump’s directive for Fannie Mae and Freddie Mac to purchase up to $200 billion in mortgage-backed securities using available balance-sheet cash has helped support MBS pricing and apply downward pressure on mortgage rates. While details around implementation are still evolving, increased MBS demand generally benefits mortgage pricing.

Economic Data Ahead

This week’s economic calendar is relatively light, with the first revision to Q3 GDP and the delayed November PCE Index scheduled for release later this week. The PCE Index is the Federal Reserve’s preferred measure of inflation, though this delayed report is not expected to materially change near-term policy expectations.

Markets were closed Monday in observance of Martin Luther King Jr. Day, with normal trading resuming for the rest of the week.

What This Means for Homebuyers and Homeowners

With mortgage rates near multi-year lows and markets increasingly focused on potential rate cuts later in the year, many buyers and homeowners are paying close attention to timing, affordability, and refinancing opportunities. While no one can predict short-term rate movements with certainty, staying informed and prepared can make a meaningful difference.

As the next round of economic data unfolds, we’ll continue breaking down what it means for mortgage rates and housing trends, with another update on the way.