Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

Mortgage rates remain elevated but have shown slight improvement recently, with a small decrease in the average 30-year fixed rate. The housing market is facing challenges such as high rates and limited inventory, making affordability a significant issue for buyers. Despite these challenges, the labor market remains strong, and inflation is gradually easing, which could influence the Federal Reserve to hold rates steady this week while markets look for signals about future rate moves.

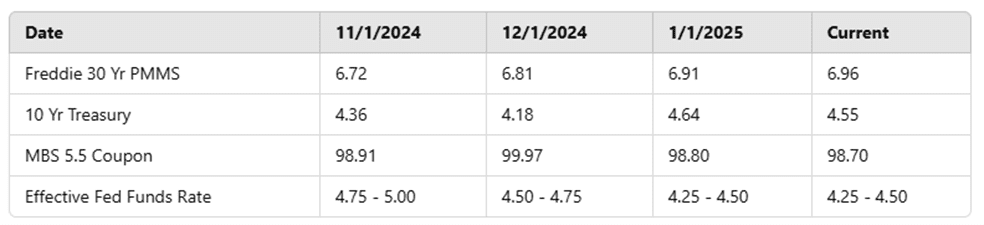

Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

“…The Fed is still expected to hold rates steady at 4.25-4.50% at its decision meeting this Wednesday. The markets will be looking for clues regarding future rate moves from the Fed and the committee’s reaction as more executive orders are announced by the Trump administration.”

Mortgage Rates and Market Trends

Last week was light on economic data, but there was some positive housing data released. Existing home sales finished the year with positive momentum and were up 2.2% in December, with gains seen across many property types. For the year, existing home sales were up 9.3%, but are still much lower than recent years. The housing market continues to face multiple challenges, including elevated mortgage rates and limited supply, which is keeping home prices from easing in most markets. Affordability remains the key challenge facing many potential homebuyers.

The labor market has been resilient as new jobless claims continue to hover near historic lows. The health of the labor market is a key area that the Fed monitors and will influence future monetary policy decisions. Inflation also remains elevated above the Fed’s 2% target but has recently shown signs of easing further. With that being said, the Fed is still expected to hold rates steady at 4.25-4.50% at its decision meeting this Wednesday. The markets will be looking for clues regarding future rate moves from the Fed and the committee’s reaction as more executive orders are announced by the Trump administration. Later in the week following the Fed’s decision, we’ll see the first look at Q4 GDP, and the PCE Inflation Index will be out on Friday. This is the first inflation data that will be released after the Fed’s meeting, and combined with the FOMC statement, it could set the stage for rates in the coming weeks.

What to Expect This Week

Mortgage rates remain elevated, but with the relief rally in the market, they have come down from recent highs. So far today, MBS prices are up by about 20-25 basis points, and the 10-Year Treasury is down sharply to 4.54%.

We’ll keep an eye on the market and share updates next week. If you’re ready to talk about your homeownership goals, don’t hesitate to contact us—we’re here to assist you!