Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

The bond market saw some changes recently, with mortgage rates slightly increasing despite the Federal Reserve lowering its benchmark rate. While the economy shows mixed signals, with jobs slowing but inflation staying high, experts think it might take longer for interest rates to drop significantly. This week, the focus is on new job data, which could give more clues about where the economy is headed.

Happy 2025! I hope everyone enjoyed the weekend! Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

“Expectations for rates have shifted, but we remain in an accommodative Fed policy and downward interest rate environment. It may just take more time than expected for rates to drop precipitously.”

Mortgage Rates and Market Trends

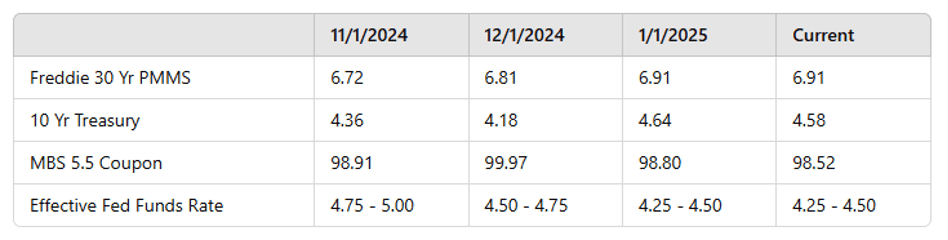

The Federal Reserve has cut its benchmark rate by 100 basis points since September 18th. However, this reduction in the Fed Funds Rate has not been reflected in mortgage rates, which have continued to rise through the end of 2024. Since the Fed began cutting, mortgage rates for conventional, FHA, and VA loans have all increased. With anticipation of future rate cuts, the conventional 30-year mortgage rate dropped from a high of 7.27% in April to 6.03% by mid-September. However, as of last Thursday, mortgage rates have edged closer to 7% again, reaching the highest levels since early July.

Recent data has been conflicting, with job numbers suggesting the economy is cooling, but inflation data showing it remains unrelentingly elevated. Expectations have shifted to a “wait and see” approach from the Fed, with additional cuts potentially being pushed out to the Spring of this year. The Fed’s 2025 forecast showed 100 basis points of cuts for the year, less than previously expected, and those cuts may not come until later in the year. Expectations for rates have shifted, but we remain in an accommodative Fed policy and downward interest rate environment. It may just take more time than expected for rates to drop precipitously.

What to Expect This Week

This week is busy with fresh data and economic news. The main focus will be on December employment data, with the ADP report out on Wednesday and the official U.S. Non-Farm Payrolls report on Friday. So far today, MBS prices are down slightly by about 5-10 basis points, and the 10-Year Treasury is up a few basis points at 4.63%.

We’ll keep an eye on the market for any shifts—check back next week for our latest updates and insights