Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

“The bond market is holding steady as investors prepare for a week filled with high-impact economic data releases and a critical Federal Reserve meeting. Current mortgage rates remain near the lower end of their recent range, providing a potential window of opportunity for homebuyers and refinancers. However, increasing political pressure on the Fed, combined with mixed economic indicators, could significantly impact upcoming Federal Reserve policy decisions and the direction of interest rates in the near future.”

Let’s take a look at the latest trends, rate movements, and what to watch for in the days ahead.

“This week is packed with potentially market-moving data releases and events. The Fed’s July FOMC meeting will culminate on Wednesday with the interest rate decision at 2:00 followed by Chairman Powell’s press conference at 2:30.”

Market Rate Observations

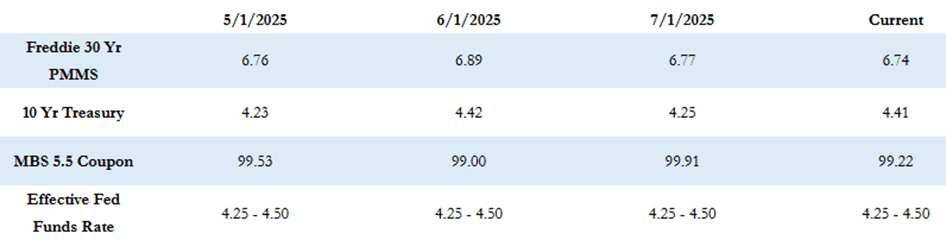

As of last Thursday, the Freddie Mac average 30-year fixed rate stood at 6.74%, down by 1 basis point from the prior week. That places the maximum APR for 30-year fixed-rate loans at approximately 8.24% (6.74% + 1.50%).

This rate has stayed within the 6.70%–6.90% range since mid-April, and currently sits at the lower end of that range. Meanwhile, the 10-Year Treasury yield closed last week at 4.39%, down 4 basis points for the week.

Fed Outlook and Political Pressure

All eyes are on this week’s Federal Reserve FOMC meeting, with the rate announcement scheduled for Wednesday at 2:00 PM, followed by Chairman Powell’s press conference at 2:30 PM. While the market fully expects the Fed to keep rates unchanged, Powell’s tone and comments will be closely watched for clues about future policy shifts.

Political tension has also entered the spotlight. There’s been speculation about potential successors to Powell, along with calls for his early resignation. The Trump administration has expressed concerns that the Fed may be acting too cautiously on rate cuts, advocating instead for more accommodative policy leadership.

Upcoming Economic Data

This week brings a full slate of key economic reports:

- Q2 GDP data – Wednesday

- ADP Employment Report – Wednesday

- PCE Index (Fed’s preferred inflation gauge) – Thursday

- Non-Farm Payrolls – Friday

The odds of a rate cut in September currently sit at about 60% for a 0.25-point reduction, though persistent inflation and labor market strength could diminish those chances. However, any shift in Fed leadership could intensify political pressure, potentially accelerating future rate cuts.

Market Snapshot: Monday Morning

As of this morning, MBS prices are worse by about 15 basis points compared to Friday’s close, and the 10-Year Treasury yield has ticked up a few basis points to 4.41%.

We’ll be watching this week’s data and Fed commentary closely. Stay tuned for further updates as we track how these developments may shape the weeks ahead.