Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

Mortgage interest rates are creeping higher as bond market volatility continues, driven by trade policy uncertainty and mixed economic indicators. With inflation data showing some relief and the Federal Reserve holding steady on rate cuts—for now—this week’s focus shifts to employment reports and what they could signal for future mortgage rate trends.”

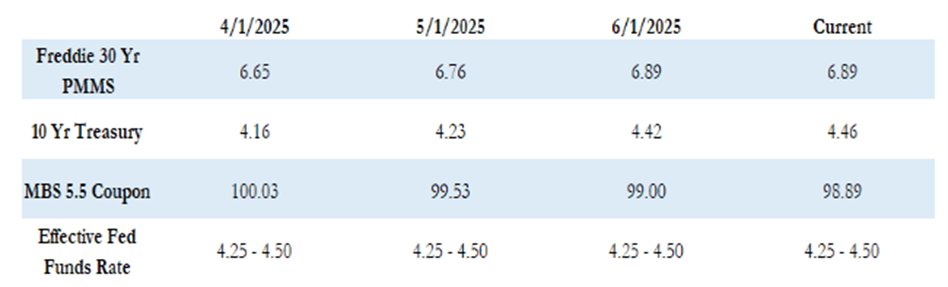

Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

“Markets and the Fed will continue to decipher the economic data and how the ever-changing trade policy coming from the Trump Administration will impact the economy and inflation.”

The Freddie Mac average 30-year fixed rate was 6.89% as of last Thursday—up 3 basis points from the prior week. That puts the max APR this week for 30-year fixed rate loans at approximately 8.39% (6.89 + 1.50). While still below 7% since mid-January, rates have been edging higher recently. The 10-year Treasury yield also reflected continued volatility, closing the week at 4.42%, down 8 basis points from the previous week.

Trade Policy & Market Volatility

Trade policy shifts—particularly from the Trump Administration—have continued to drive market volatility since April. Some easing of U.S.–China tariffs last week helped lower inflation expectations slightly, but significant uncertainty remains around how future tariff decisions will influence the economy. Chairman Powell has noted that tariffs could drive up inflation while simultaneously weakening economic conditions. However, their exact impact is still unclear.

Economic data last week painted a mixed picture. The PCE index, the Fed’s preferred inflation gauge, came in slightly below expectations, with a 2.5% year-over-year increase—the lowest in nearly four years. While inflation concerns persist, current data hasn’t yet confirmed a rising trend.

Upcoming Economic Reports & Outlook

This week’s focus shifts to employment data. The ADP employment report will be released Wednesday, followed by the official May U.S. Employment Report on Friday. Other important releases include productivity, construction spending, and consumer credit—making for a busy economic calendar.

As of now, the probability of a Fed rate cut in June is below 5%. July shows about a 25% chance, while the September meeting carries roughly a 50% probability of a 0.25-point cut. Most economists currently forecast just one or two quarter-point cuts by year-end—a significant shift from early-year expectations.

The next FOMC meeting is scheduled for June 18. In the lead-up, markets will be watching closely for signals from the Fed, especially as it relates to the evolving trade landscape. Several Fed officials are set to speak this week, including Chairman Powell today at 1:00 PM.

So far today, MBS prices are down roughly 10 basis points from Friday’s close, and the 10-year Treasury yield has ticked up slightly to 4.44%.

We’ll continue tracking developments and data closely—thanks for reading, and here’s to staying informed as the market evolves.