Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

Mortgage rates remain stable, but recent Federal Reserve projections hint at slower growth, a softening labor market, and a slightly higher near-term inflation outlook. Meanwhile, economic data releases this week, including the PCE inflation index, could influence future rate expectations.

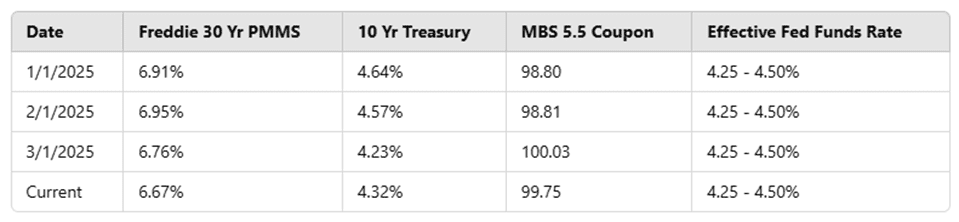

Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

“Last week, the FOMC left the Fed Funds Rate unchanged at 4.25-4.50% as expected. Despite keeping rates steady, their latest projections suggest a slowdown in economic growth, a weakening labor market, and a slightly elevated near-term inflation outlook.”

Mortgage Rate Trends and Market Sentiment

Mortgage rates saw a steady decline for seven weeks before experiencing slight increases over the past two. Since mid-January’s high of 7.04%, rates have dropped 37 basis points. Treasuries and mortgage-backed securities (MBS) have been trading within a tight range, providing some much-needed stability following a year of volatility.

Federal Reserve Outlook

The FOMC’s decision to hold rates steady was expected, but Chairman Powell’s comments reinforced a cautious and flexible approach amid economic uncertainty. The updated dot plot showed no adjustments to interest rate projections, despite lower GDP forecasts and higher inflation expectations.

Looking ahead, the Fed remains data-dependent, with the next three FOMC meetings scheduled for May, June, and July. Current futures markets suggest an 80% probability of no change in May, but a 60% chance of a 25-basis-point cut in June.

Key Economic Data Releases This Week

This week brings several critical economic reports that could impact market sentiment:

• Housing Data: Case-Shiller Home Price Index (Tuesday), New & Pending Home Sales (Tuesday & Wednesday)

• GDP and Personal Income Reports: A fresh look at Q4 2024 GDP, personal income, and spending

• PCE Inflation Index (Friday): The Fed’s preferred inflation gauge, marking its first release since last week’s FOMC meeting

• Fed Speaker Events: Multiple appearances from Fed governors and presidents discussing their economic outlooks

Market Conditions Today

As of this morning, MBS prices are down 10-15 basis points, while the 10-year Treasury yield has climbed 7 basis points to 4.32%. With a packed schedule of economic data releases, this week will be a crucial one for the market as we approach the end of March.

Stay tuned for more updates as we monitor rate movements and economic trends!