Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

“Interest rates and bond markets remain volatile as the Federal Reserve takes a cautious, data-driven approach amid shifting trade policies and pending tax legislation. Upcoming economic data releases and policy developments are expected to provide clearer insight into the strength of the U.S. economy.”

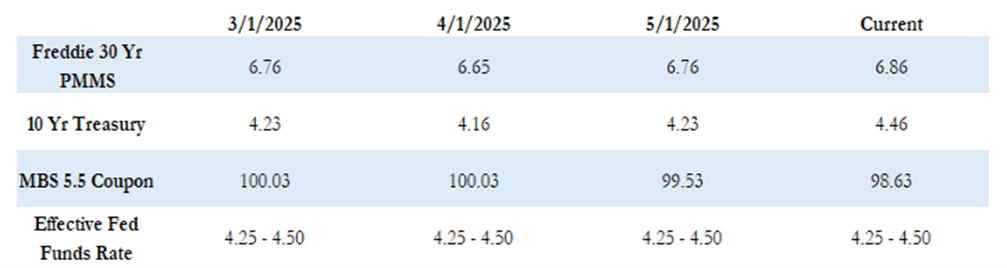

Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

“With all the data being released, by the end of the week we should have a much clearer view of how the U.S. economy is holding up amid Trump’s sweeping trade policy changes, and the tax bill currently in Congress.”

Rate and Bond Market Overview

The Freddie Mac average 30-year fixed rate is at 6.86% as of last Thursday, up another 5 basis points compared to the prior week. That puts the maximum APR this week for 30-year fixed rate loans at roughly 8.36% (6.86% + 1.50%). Despite recent increases in rates and the extreme volatility, the average 30-year rate has remained below 7% since mid-January. The 10-year Treasury yield has also been volatile, closing the week at 4.51%, an increase of 7 basis points. However, rates are on the decline so far today.

Trade Policy and Market Volatility

Trade policy coming from the Trump Administration was the main driver behind the recent volatility in the bond markets. Fed Chairman Powell has indicated that the tariffs could lead to both higher inflation and weaker economic conditions in the U.S. However, there’s still little clarity on the actual impact the tariffs will have on employment and inflation, and the tariff details continue to shift. Just last week, Trump reignited trade tensions by threatening a 50% tariff on the European Union, which he then delayed on Sunday.

Federal Reserve Outlook

As a result, the Fed has no choice but to maintain a cautious, data-dependent approach. Everyone—including the Fed—is still waiting for clearer signs of how trade policy is affecting the real economy, and current economic data tends to lag. That said, the risk of a U.S. recession has decreased in recent weeks due to strong employment and consumer spending data.

Because of this, it’s widely expected that the Fed will delay any rate cuts until September at the earliest. The probability of a cut in June is less than 5%, in July it’s about 25%, and for the September meeting, there’s about a 50% chance of a 0.25-point rate cut. Most economists now expect just one or two 0.25-point cuts by the end of the year—a significant shift from expectations earlier this year.

What to Watch This Week

The next FOMC meeting is scheduled for June 18, and as it approaches, markets will be looking for more clarity on Fed policy, particularly in response to Trump’s trade strategy. In addition, Trump’s “big, beautiful” tax bill is progressing through Congress this week. The bill is expected to widen the U.S. deficit and could impact the bond markets.

Last week was extremely light on new economic data, but this week brings several important releases, including:

- Q1 GDP on Thursday

- Personal income, spending, and inflation data on Friday

- May Fed meeting minutes on Wednesday

- Multiple Fed speaking engagements throughout the week

With all the data being released, by the end of the week we should have a much clearer view of how the U.S. economy is holding up amid Trump’s sweeping trade policy changes and the tax bill currently in Congress.

As of today, MBS prices are up by about 15–20 basis points compared to Friday’s close, and the 10-year Treasury yield has dropped by about 5 basis points to 4.46%.

Stay tuned for more insights as the week unfolds.