Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

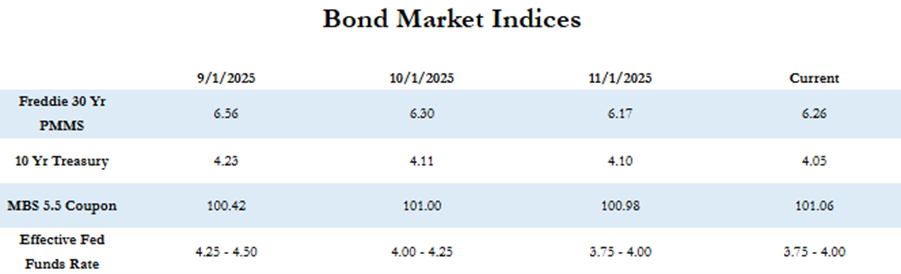

Mortgage rates remain relatively stable, with the Freddie Mac 30-year fixed average at 6.26% and the 10-Year Treasury at 4.06%. Market uncertainty has persisted due to the 43-day federal government shutdown, which delayed key economic data until last week. The first major release—September’s employment report—showed strong job gains but mixed signals overall, reducing expectations for a December Fed rate cut to about 30%. With the Fed’s next meeting approaching on December 10th, the bond market’s direction will hinge on this week’s wave of delayed and scheduled data releases, including PCE, GDP, and Retail Sales. As of this morning, MBS prices are slightly higher and Treasury yields slightly lower, though market activity is expected to be muted due to the holiday week.

Let’s break down the latest movements in the bond market and what may be ahead this week

“Treasury rates and mortgage rates have stayed within a tight range since the beginning of October and the direction of the bond markets hinges heavily on updated economic data and the Fed’s December FOMC meeting which is coming up quickly on December 10.”

Market Overview

As of last Thursday, the Freddie Mac average 30-year fixed rate stands at 6.26%, a modest increase of 2 basis points from the prior week. This places the estimated maximum APR for 30-year fixed loans at approximately 7.76% (6.26 + 1.50). The 10-Year Treasury yield ended last week at 4.06%, down 8 basis points from the prior week.

The 43-day federal government shutdown—the longest in U.S. history—created significant uncertainty beginning in early October. While the shutdown ended on November 10th, delayed economic data only began to resume last week. During this period, Treasury and mortgage rates have remained within a tight range. The near-term direction of the bond market will depend heavily on incoming economic reports and the Federal Reserve’s next FOMC meeting on December 10th.

The first major delayed release, the September employment report, showed a strong gain of 119,000 jobs—well above the expected 50,000. However, the report also included substantial downward revisions to prior months and a slight increase in the unemployment rate from 4.3% to 4.4%. Markets interpreted the report as mixed. As a result, expectations for a Fed rate cut in December have fallen to roughly 30%, according to Fed Funds futures. Minutes from the October FOMC meeting highlight growing divisions among Fed officials regarding whether inflation risks or labor-market softening should take precedence. Several members have recently indicated that they do not anticipate a policy change in December, citing the need for more current data following the shutdown.

Looking Ahead

Despite the holiday, this week includes a substantial slate of economic releases. Delayed reports such as the October PCE Index, Q3 GDP, and New Home Sales are expected, along with regularly scheduled reports including the Producer Price Index, Retail Sales, Consumer Confidence, and Pending Home Sales—most of which will be released on Tuesday.

As of this morning, MBS prices are up slightly by 5–10 basis points compared to Friday’s close, and the 10-Year Treasury yield has dipped to 4.05%. While data will resume flowing this week, the upcoming holiday closures are expected to keep market activity relatively subdued.

Have a great week!