Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

The September 2, 2025 Weekly Market Update highlights falling mortgage rates, improving MBS spreads, and shifting expectations for Federal Reserve policy. With the Freddie Mac 30-year fixed average at 6.56%—its lowest since last October—borrowers are seeing more favorable conditions as the bond market stabilizes. The Fed is expected to cut rates in September, with futures markets pointing to an additional cut before year-end. Investors and homebuyers will be closely watching this week’s employment data, including the ADP and nonfarm payrolls reports, which could further shape mortgage rates and housing market trends through the fall.

Let’s take a look at the latest trends, rate movements, and what to watch for in the coming weeks.

“Rate expectations have shifted in recent weeks but remain fluid as the markets have been weighing weaker labor market data and tame inflation readings”

Rate Movement

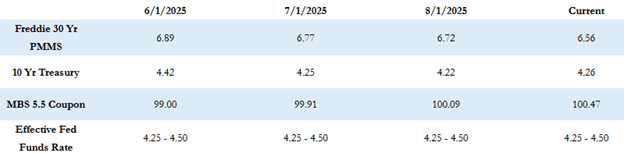

The Freddie Mac average 30-year fixed rate fell to 6.56% last Thursday, down 2 basis points from the prior week. That puts the maximum APR this week for 30-year fixed rate loans at roughly 8.06% (6.56 + 1.50).

The index has now declined for six consecutive weeks and broke below 6.60% for the first time since October of last year. The 10-year Treasury yield closed last week at 4.23%, a decrease of 3 basis points.

Economic and Fed Outlook

Rate expectations have shifted in recent weeks but remain fluid as markets weigh weaker labor market data and tame inflation.

- The Core PCE inflation reading rose 0.3% in July, matching expectations.

- Initial jobless claims declined, while Q2 GDP was revised upward.

These data points suggest the labor market is cooling, though not in a dire position. Current expectations are for two Fed rate cuts by year-end. Markets view a 0.25% cut at the September 18th meeting as nearly certain, with a good chance of another cut in October or December.

Mortgage-Backed Securities (MBS) prices have continued to improve relative to Treasuries. The spread between the 10-year Treasury and 30-year fixed mortgage rates has tightened closer to its historical average, though it remains elevated. If this spread continues to narrow, mortgage rates could improve through year-end even without a significant move in Treasury yields.

This Week’s Schedule

The economic calendar is fairly light, but the focus will be on employment data:

- Thursday – ADP employment report

- Friday – August nonfarm payrolls report

So far today, MBS prices are worse by about 15 basis points compared to Friday’s close, and the 10-year Treasury is up a few basis points to 4.26%.

We’ll continue to monitor the markets closely and provide updates as new data and Fed commentary unfold in the weeks ahead, and we wish you a great week ahead.