Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

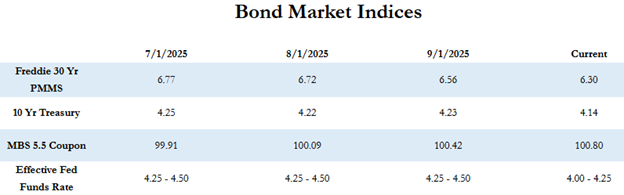

Mortgage rates inched slightly higher last week, with the Freddie Mac 30-year fixed average rising to 6.30% after a long stretch of declines. Despite the Federal Reserve’s September 17th rate cut, bond yields moved upward as stronger-than-expected GDP and employment data tempered hopes for additional easing. The 10-year Treasury yield closed at 4.19%, up 5 basis points for the week, while markets now turn their focus to fresh employment numbers and a wave of Fed speeches that could provide more clues about the path of monetary policy.

Let’s take a look at the latest trends, rate movements, and what to watch for in the coming weeks.

“Despite the Fed cutting the benchmark Fed Funds rate on 9/17, bond yields have actually risen since then. The 10 year Treasury is up about 12 basis points since the cut and the Freddie Mac PMMS is up by 4 basis points during the same time.”

Rate Movement

The Freddie Mac average 30-year fixed rate stood at 6.30% as of last Thursday, an increase of 4 basis points compared to the prior week. That puts the max APR this week for 30-year fixed rate loans at roughly 7.80% (6.30 + 1.50). Before last week’s uptick, the index had seen declines for eight consecutive weeks, including a 9 basis point drop the week prior and a 15 basis point drop the week before that—the largest weekly decrease in the past year. The 10-year Treasury yield closed last week at 4.19%, up 5 basis points from the week before.

Economic and Fed Outlook

Despite the Fed cutting the benchmark Fed Funds rate on September 17th, bond yields have actually risen since then. The 10-year Treasury is up about 12 basis points since the cut, and the Freddie Mac PMMS is up by 4 basis points during the same time. Interest rate expectations continue to shift with new economic data. Last week, revised Q2 GDP showed a surge to 3.8%, well above initial expectations, while initial jobless claims showed a significant week-over-week drop. These strong data points underscore the resilience of the U.S. economy, but the strength could put further rate cuts this year in jeopardy.

The PCE inflation index was also released last week and came in at 2.9%, right at expectations but still well above the Fed’s 2% target. The market’s hope for continued rate relief following the September FOMC meeting has been tempered by the Fed’s cautious stance in light of stubborn inflation data and solid economic performance. However, Fed Funds futures still show nearly a 90% chance of another quarter-point rate cut at the end of October. It will be interesting to see how those expectations evolve in the coming weeks.

This Week’s Schedule

This week the economic calendar is fairly light, but the September employment numbers will take center stage. The ADP employment report is due Wednesday, followed by the official U.S. Non-Farm Payrolls report on Friday. The week is also filled with Federal Reserve speaking engagements, which could spark volatility depending on the tone of policymakers. So far today, MBS prices are generally flat compared to Friday’s close, while the 10-year Treasury yield has edged down a few basis points to 4.14%.

Here’s to a productive week ahead as markets balance strong economic data with the Fed’s cautious policy outlook.