Exciting News For Homebuyers!

Starting November 18, 2023, Fannie Mae is expanding Loan-to-Value limits on multi-family properties for purchase and limited cash-out. This means increased access to credit and support for affordable rental housing.

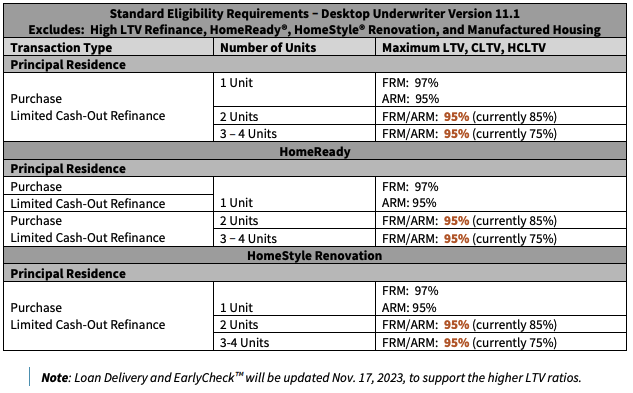

A key change includes a boost in maximum allowable LTV, CLTV, and HCLTV ratios to 95% for two-to-four-unit, principal residence, purchase, and limited cash-out transactions.

Make sure to take note – these changes apply to loans submitted on or after November 18, 2023. 📆

Read the FNMA official release documentation.

Stay ahead in the mortgage game and speak with your local NMB Loan Officer to learn more!

* Please note: these exciting changes won’t apply to high-balance mortgage loans and manually underwritten loans. Some restrictions may apply. Contact your loan officer to discuss terms, guidelines, and program information.