Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

“The Fed meets this week to decide on interest rates, and while no changes are expected yet, markets are watching closely for hints about a possible rate cut in June. Despite recent economic uncertainty from new tariffs, job growth remains strong, and mortgage rates have stayed under 7% since January.”

Key Takeaways: Bond Market Trends and Fed Outlook

“This week, the economic calendar is light on data releases, but the May FOMC Fed meeting starts tomorrow and concludes Wednesday with the rate decision and Chairman Powell’s press conference.”

Rate Stability & Affordability

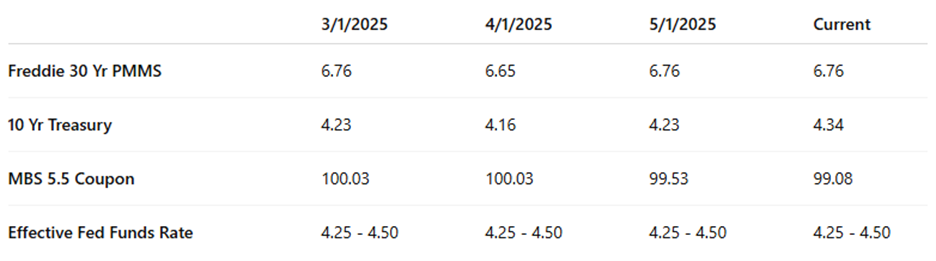

The Freddie Mac average 30-year fixed rate remains at 6.76% as of last Thursday, down by 5 basis points from the prior week. This places the max APR for 30-year fixed-rate loans at roughly 8.26% (6.76% + 1.50%). Despite recent increases and market volatility, the average 30-year rate has stayed below 7% since mid-January.

The 10-year Treasury yield continues to reflect volatility, closing last week at 4.32%, up 5 basis points over the week.

Market Drivers & Economic Outlook

The new tariff policy from the Trump Administration has introduced significant volatility in financial markets in recent weeks. However, markets showed some signs of calming last week. While uncertainty remains, Fed Chairman Powell has warned that tariffs could fuel both higher inflation and weaker economic growth. With unclear impacts on employment and inflation, the Fed is expected to continue a cautious, data-dependent approach.

Expectations going into last Friday’s nonfarm payrolls report were muted due to potential tariff effects on the labor market. However, the headline number surprised to the upside at 177,000 jobs, well above the forecast of 133,000. The labor market remains strong. Additionally, the PCE index—the Fed’s preferred inflation gauge—came in right on target with a 2.6% year-over-year increase. While inflation remains above the Fed’s 2% target, it has moderated recently. Still, tariff-related risks could reverse this trend.

Given strong employment and manageable inflation, the Fed is unlikely to take action this week. Current market pricing shows less than a 10% chance of a rate cut in May, with a 50% probability of a cut in June.

Later this week, several Fed presidents will speak publicly, and their remarks may provide more insight into how the Fed’s stance could evolve in light of new economic data and ongoing tariff uncertainties.

As of this morning, MBS prices are flat, and the 10-year yield has risen slightly by 2 basis points to 4.34%. With a light calendar, all eyes remain on the Fed—and we may see volatility continue to ease in the near term.

Stay tuned for next week’s market update!