Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

Mortgage rates remain volatile, with the average 30-year fixed rate hovering just under 7% as financial markets react to shifting inflation data, labor market reports, and U.S. trade policy uncertainty. With the next Federal Reserve meeting approaching and CPI and PPI inflation reports due this week, homebuyers and real estate professionals should stay alert to potential mortgage rate changes and economic policy updates.

Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

“In general, the mortgage and housing markets remain very sensitive to macroeconomic and policy shifts. The direction of the bond market and mortgage rates depends heavily on trade clarity, inflation, and labor market resilience.”

Rate and Bond Market Overview

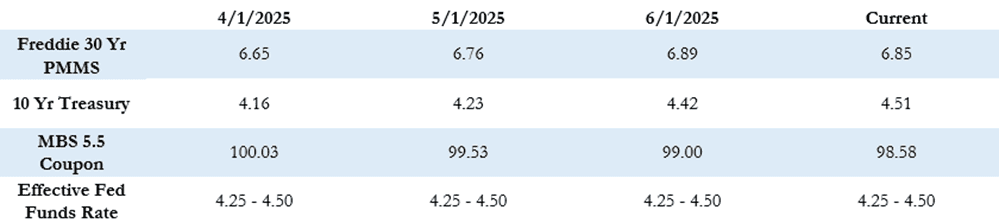

The Freddie Mac average 30-year fixed rate is at 6.85% as of last Thursday and was down by 4 basis points compared to the prior week. That puts the max APR this week for 30-year fixed rate loans at roughly 8.35% (6.85 + 1.50). Despite recent increases in rates and the extreme volatility caused by uncertainty with trade policy, the average 30-year rate has been below 7% since mid-January but has pushed up close to 7% recently. The 10-year Treasury yield has also been very volatile and closed the week at 4.51%, which was an increase of 10 basis points for the week.

Economic Data Recap

Last week’s data supported that the U.S. economy is showing increased signs of strain. The ADP May employment report fell well short of expectations, showing only 37k jobs added vs. the expectation of 110k. The report fueled concerns that the labor market is cooling. However, the official U.S. Non-farm Payrolls report on Friday showed a modest increase of 139k jobs, which was slightly above expectations. The unemployment rate remained steady at 4.2%, and wage growth remained solid. Despite the mixed labor market picture, the bond market sold off further on Friday. Market participants are beginning to question how long the Fed can maintain its current stance without risking a more severe economic slowdown. Uncertainty around trade policy, the stalled negotiations with China, and newly doubled steel and aluminum tariffs continue to weigh heavily on markets. The changing trade dynamics have complicated forecasts and economic modeling, which is limiting Fed policymakers’ ability to respond with precision and good timing. Most economists still expect Fed rate cuts in 2025, but some do still expect no change. The probability of a cut at the Fed’s June meeting is now basically 0%. There is about a 20% chance of a .25 cut in July, and then we see the probability jump up over 50% for a .25 point cut in September. Most economists expect just one or two .25 point cuts by the Fed by the end of the year, which is a big departure from expectations at the beginning of the year. The current range for the Fed Funds rate is 4.25%-4.50%, so the consensus forecast by year-end is 3.75%-4.25%.

What to Watch This Week

In general, the mortgage and housing markets remain very sensitive to macroeconomic and policy shifts. The direction of the bond market and mortgage rates depends heavily on trade clarity, inflation, and labor market resilience. The next FOMC meeting is June 18th, and as that meeting approaches, markets will be looking for more clarity on the Fed’s policy and how it relates to Trump’s trade policy, employment, and inflation. This week the economic calendar is fairly light, but there is important inflation data on tap. The May Consumer Price Index (CPI) and Producer Price Index (PPI) will be out on Wednesday and Thursday, respectively. There are no Fed speaking engagements this week as they are in their blackout period ahead of next week’s FOMC meeting and rate decision on June 18th.

So far today MBS prices are better by about 10 basis points compared to Friday’s close, and the 10-year is down by a few basis points to 4.47%.

Stay tuned for more insights next week!