Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

“Mortgage rates held steady last week, with the average 30-year fixed rate remaining near recent lows—good news for homebuyers watching affordability. However, strong economic data and lingering inflation are making a Federal Reserve rate cut unlikely in the near future, which could keep mortgage rates elevated and impact homebuying decisions in the coming months.”

Let’s take a look at the latest bond market trends, upcoming Federal Reserve rate decisions, and economic data releases that could influence mortgage rates, housing affordability, and homebuyer confidence.

“The data remains mixed, and the Fed has reinforced its wait-and-see, data-dependent stance. The Fed is clearly in no rush to cut rates despite political pressure to do so.”

Market Rate Observations

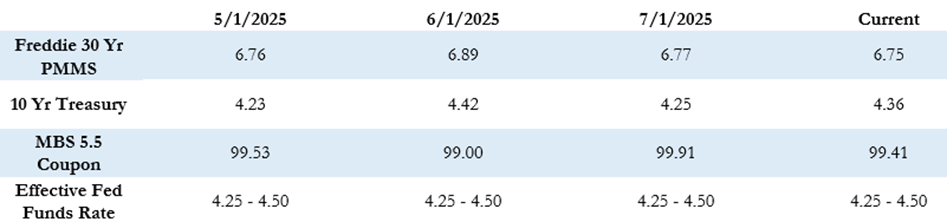

The Freddie Mac average 30-year fixed rate is at 6.75% as of last Thursday, up by 3 basis points compared to the prior week. That puts the max APR this week for 30-year fixed-rate loans at roughly 8.25% (6.75% + 1.50%). The index has remained in the 6.70%–6.90% range since mid-April and currently sits at the lower end of that range.

The 10-Year Treasury yield closed last week at 4.43%, which was generally flat for the week.

Economic Data Recap

Last week brought a busy economic calendar with several stronger-than-expected data releases, including robust June retail sales numbers and a decline in weekly jobless claims. This reinforced the resilience of the U.S. consumer and the ongoing strength in employment.

Stronger economic data makes a near-term interest rate cut by the Federal Reserve increasingly unlikely. Currently, there are virtually no expectations for a cut at the upcoming July meeting. However, inflation remains a concern. CPI rose 2.7% year-over-year, and PPI rose 2.5% year-over-year. While both figures came in at or slightly below expectations, they are still above the Fed’s 2% target.

Interestingly, categories like appliances and home goods posted the highest monthly price increases in years—an indication that tariff-related cost pressures may be reaching the end consumer.

Fed Policy Outlook and Political Pressure

The Fed remains cautious, holding firm to a data-driven, wait-and-see approach. Speculation has increased around possible successors to Fed Chair Jerome Powell, with some political voices calling for his early resignation before his term expires in 2026.

The Trump administration believes the Fed risks moving too slowly on rate cuts and is advocating for a more accommodative leadership. Market odds for a rate cut in September currently stand at around 60% for a 0.25-point reduction. Still, with inflation elevated and labor market strength persisting, those chances may begin to fade.

Should a more dovish successor to Powell be announced early, political pressure could mount, potentially accelerating a shift in Fed policy toward rate cuts sooner than currently expected.

What’s Ahead This Week

This week’s economic calendar is light but includes new housing data and a few Federal Reserve speaking engagements, including Chairman Powell’s opening remarks at the National Banking Conference.

So far today, MBS prices are better by about 20 basis points compared to Friday’s close, and the 10-Year Treasury is down sharply to 4.35%.

We’ll continue to monitor key developments and provide insights as the market evolves throughout the week.