- Lower Down Payments: Enjoy down payment options as low as 3%, with up to 2% as gift funds.

- No Mortgage Insurance Required: Save more by eliminating the mortgage insurance requirement, lowering your monthly payments.

- Flexible Credit Requirements: More buyers can qualify with our flexible credit criteria.

- Comprehensive Education: Our homeownership education program prepares you for the responsibilities of owning a home.

- Competitive Interest Rates: Benefit from competitive interest rates similar to conventional loan rates.

- Single Family Homes: Includes 1-unit properties, condos, PUDs, and co-ops.

- 2 Unit Homes

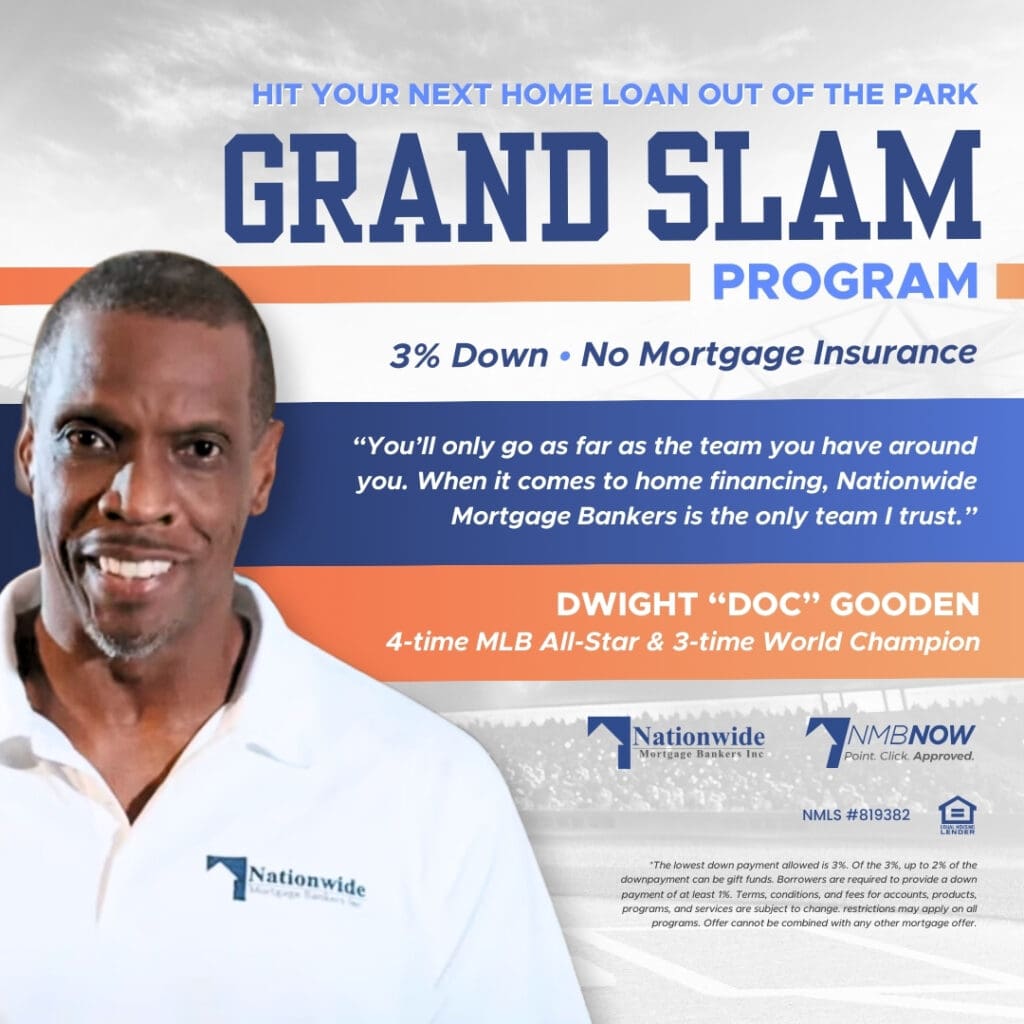

“You’ll only go as far as the team you have around you. When it comes to home financing, Nationwide Mortgage Bankers is the only team I trust.”

—DWIGHT “DOC” GOODEN, 4-time MLB All-Star & 3-time World Champion

Eligibility Requirements

- Fixed Rate Loans: Available in 10-, 15-, 20-, 25-, or 30-year terms.

- Max LTV 97%: Loan-to-value ratio must not exceed 97%.

- Conforming Loan Limits: Loan amounts must adhere to these limits.

- Property Location: Must be in a low- to moderate-income census tract.

- Select MSAs: Eligibility restricted to specific Metropolitan Statistical Areas.

- Homebuyer Education: Required unless waiver conditions are met.

- Reserves Required: Applicants must have reserves.

- Primary Residence Only: The property must be your primary residence.

- Full Appraisal Required: A complete appraisal is necessary.

Ready to step up to the plate and hit your home loan out of the park? Contact us today to get started with the NMB Grand Slam Program and make your homeownership dreams come true!

(The lowest down payment allowed is 3%. Of the 3%, up to 2% of the downpayment can be gift funds. Borrowers are required to provide a down payment of at least 1%. Terms, conditions, and fees for accounts, products, programs, and services are subject to change. restrictions may apply on all programs. Offer cannot be combined with any other mortgage offer.)