Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

Mortgage rates continue their steady decline, with the Freddie Mac 30-year fixed average dropping to 6.50%—its lowest level since October 2024. The 10-year Treasury yield closed at 4.07%, reflecting market optimism fueled by weaker labor market data and tame inflation. Refinance applications surged to their highest share since last October, as falling rates created new opportunities for homeowners. Looking ahead, markets are anticipating a 0.25% rate cut at the Federal Reserve’s September 17th meeting, with some expecting a larger cut. Inflation data due this week will be closely watched, but absent surprises, the downward trend in mortgage rates is expected to continue into the fall.

Let’s take a look at the latest trends, rate movements, and what to watch for in the coming weeks.

“As rates continue to drop, the number of homeowners who have the opportunity to refinance will continue to expand, and last week the share of refinance mortgage applications reached 47% which was the highest since last October.”

Rate Movement

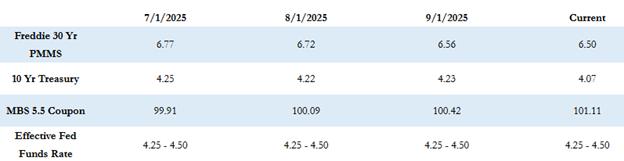

The Freddie Mac average 30-year fixed rate fell to 6.50% as of last Thursday, a drop of 6 basis points from the prior week. This marks the seventh consecutive weekly decline and the first time since October 2024 that rates have reached this level. Based on current spreads, the maximum APR for 30-year fixed loans is approximately 8.00% (6.50 + 1.50).

The 10-year Treasury yield ended last week at 4.09%, down sharply by 14 basis points, while MBS prices improved meaningfully, continuing the summer rally.

Economic and Fed Outlook

Expectations for Federal Reserve policy have shifted significantly in recent weeks. Weaker labor market data and softer inflation readings have strengthened the case for a September rate cut.

- Initial jobless claims rose more than expected.

- Both the ADP employment report and Nonfarm Payrolls missed forecasts, with downward revisions to prior months.

- The Fed is under growing pressure for having prioritized inflation over labor market stability.

The Fed Funds futures market now shows a 0.25% cut at the September 17th meeting as almost certain, with rising odds of a 0.50% cut.

This Week’s Schedule

This week’s economic calendar is light aside from fresh inflation data:

- Wednesday – August Producer Price Index (PPI)

- Thursday – August Consumer Price Index (CPI)

Forecasts call for modest monthly increases, and unless there is a major upside surprise, inflation is not expected to disrupt the downward trend in rates.

Market Snapshot Today

So far today, the bond rally is extending into the new week. MBS prices are up about 10–15 basis points, and the 10-year Treasury yield has eased to 4.05%.

We’ll continue to watch these developments closely and share updates as the Fed’s September decision approaches. Wishing you a productive and positive week ahead.