Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

The second week of November opens with modest rate movement and continued market uncertainty amid the ongoing U.S. government shutdown. Mortgage rates have edged slightly higher even after the Federal Reserve’s recent rate cut, underscoring the complex relationship between Fed policy and long-term bond yields. This week’s focus will turn to key inflation data, with the Consumer Price Index (CPI) and Producer Price Index (PPI) reports scheduled for release later in the week—potentially influencing rate expectations going into the Fed’s next meeting on December 10th.

Let’s take a look at how these developments are shaping the bond and mortgage markets this week.

“This week is very light on scheduled economic data releases and even if the government does reopen, most economic reports will still be delayed. However, this week there is fresh inflation data due out with the Consumer Price Index (CPI) on Thursday and the Producer Price Index (PPI) on Friday.”

Market Overview

Last week was relatively quiet as the U.S. government shutdown continued, delaying several major economic reports. The most notable omission was the official U.S. employment report, which was postponed for the second month in a row. However, the private sector ADP employment report, released on Wednesday, showed a modest increase for October—slightly exceeding expectations.

Despite that, markets remain cautious as participants grapple with signs of weakening labor data, a prolonged government shutdown, and broader evidence of cooling economic growth.

Rates and Fed Outlook

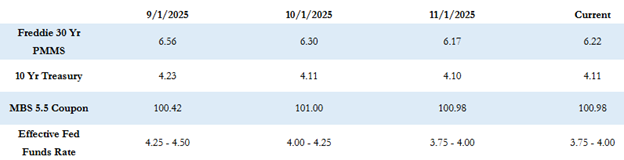

Following the Federal Reserve’s October 29th rate cut, mortgage rates have actually risen slightly, reminding both borrowers and loan officers that the Fed’s overnight rate doesn’t directly determine long-term mortgage pricing. While the Freddie Mac average 30-year fixed rate now stands at 6.22%, the 10-Year Treasury yield remains around 4.09%.

The nuance lies in how long-term rates respond to investor sentiment, inflation expectations, and supply-and-demand dynamics—factors that extend beyond the Fed’s short-term policy moves. The next FOMC meeting is scheduled for December 10th, and current market odds reflect a roughly 60% chance of another 0.25% rate cut.

Economic and Political Developments

Over the weekend, the Senate made progress toward ending the ongoing government shutdown, advancing legislation to reopen federal operations. However, the timing and details remain uncertain, and even if the government resumes activity this week, many economic data releases are expected to face continued delays.

Meanwhile, attention will be on the CPI report (Thursday) and PPI report (Friday)—two key indicators that could influence rate movement as we move deeper into Q4. Aside from those releases, this week will be relatively quiet, though numerous Federal Reserve officials are scheduled to speak, which could also sway market sentiment.

Markets will be closed Tuesday, November 11th, in observance of Veterans Day, with no pricing or lock activity that day. As of this morning, MBS prices are slightly weaker, down about 5–10 basis points, while the 10-Year Treasury yield has edged up a few basis points to 4.11%.

Outlook

With inflation data ahead and the government shutdown still unresolved, markets are likely to remain cautious in the near term. Investors will continue to monitor Fed commentary and economic indicators for clarity on the direction of monetary policy heading into year-end.

Here’s to a productive week as we move through November—steady focus and informed perspective remain the best tools in navigating today’s evolving market landscape.