Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

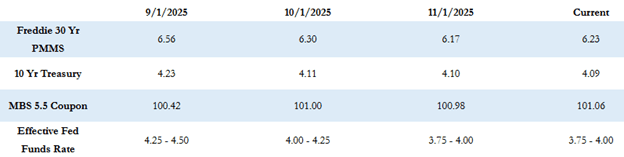

This week’s bond market update highlights the December 10th FOMC meeting, key economic releases including the ADP Employment Report and PCE Inflation Index, and current trends in mortgage and Treasury rates. Freddie Mac’s 30-year fixed average sits at 6.23%, while the 10-Year Treasury yields 4.09%. With the market pricing in an 85% chance of a December rate cut, investors and mortgage professionals are closely monitoring labor market data and inflation signals to anticipate the Fed’s policy moves and bond market reactions.

Let’s take a closer look at what’s driving this week’s rate movements and economic sentiment.

“…the market is still pricing in a rising likelihood of a December rate cut, and the current odds are at about 85% for a .25% cut on December 10th.”

The Freddie Mac 30-year fixed rate average was 6.23% as of last Thursday, down 3 basis points from the prior week. This puts the max APR this week for 30-year fixed-rate loans at roughly 7.73% (6.23 + 1.50). The 10-Year Treasury yield closed last week at 4.02%, down 4 basis points for the week.

Market and Economic Overview

Last week was relatively quiet due to the holiday, but economic data delayed by the government shutdown has started to flow again. Treasury rates and mortgage rates have remained in a fairly tight range since early October, with bond market direction hinging heavily on updated economic data and the Fed’s December FOMC meeting on December 10th.

The delayed September employment report showed an increase of 119k jobs, with the unemployment rate rising slightly to 4.4%. The report also included downward revisions to prior months’ numbers. The weak report suggests the broader labor market is slowing, with reduced hiring and elevated jobless claims. This weakening trend, combined with inflation still around 3%, sets the stage for an interesting Fed FOMC meeting and rate decision next week.

Minutes from the October FOMC meeting highlighted a growing divide among Fed members regarding whether higher inflation or downside labor market risks should take priority. Some Fed members have publicly stated that no policy changes are necessary in December, reasoning that they need more time for economic data to catch up. However, the market still sees an increasing likelihood of a December rate cut, with current odds at approximately 85% for a 0.25% cut on December 10th.

Economic Data to Watch This Week

Key releases this week include:

- Wednesday: ADP Employment Report and Import Price Index

- Friday: PCE Inflation Index (Fed’s preferred gauge of inflation)

The November U.S. employment report, normally due Friday, is delayed until December 16th. In the meantime, the ADP report and weekly initial jobless claims will serve as substitutes ahead of the Fed’s decision.

Early Market Activity

So far today, MBS prices are down slightly by 10–15 basis points compared to Friday’s close, while the 10-Year Treasury is up sharply by 7 basis points to 4.09%. With multiple economic data releases scheduled before the FOMC meeting, it promises to be a very active week for bond markets and mortgage rates.

Looking Ahead

Investors should monitor the upcoming economic data closely, as the Fed’s December decision will play a major role in shaping short-term interest rates and bond market trends. Early December lock volume may see a rebound as mortgage rates remain relatively stable, creating opportunities for both borrowers and lenders to position themselves ahead of the holiday season.

As we head into a busy week of economic releases and the upcoming FOMC decision, staying informed will be key for navigating mortgage and bond market opportunities with confidence.