Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

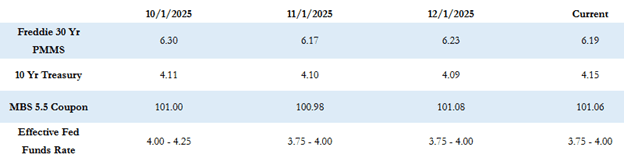

Mortgage rates remain near year-to-date lows as markets await this week’s final Federal Reserve meeting of 2025. With rate expectations already priced in, investor focus has shifted toward labor market trends, forward guidance, and the Fed’s tone regarding potential policy easing in early 2026. Treasury yields moved slightly higher to start the week, while MBS prices dipped modestly, reflecting the market’s cautious posture heading into Wednesday’s announcement.

Let’s take a closer look at what’s driving this week’s rate movements and economic sentiment.

“Fed futures markets are pricing in about a 90% chance that the Fed will cut its benchmark rate by .25% on Wednesday, followed by a pause in rate cuts at their January meeting.”

Rate Trends and Market Drivers

Mortgage rates fell for the second consecutive week and remain within just a few basis points of the year-to-date lows. To put the year in perspective, the 30-year fixed rate began 2025 at 6.91%. Rates have since declined 72 basis points and are now only 2 basis points above the low reached in late October.

Since mid-September, mortgage rates have held a relatively stable range around 6.25%. With inflation concerns fading—and tariff-related fears never materializing—the bond market has shifted its attention to the labor market as the primary determinant of Fed policy direction.

This week, the Federal Open Market Committee will close out the year with its final rate decision on Wednesday at 2:00 p.m., followed by Chairman Powell’s press conference at 2:30. While the expected quarter-point cut is already priced into the market, the Fed’s tone, guidance, and updated projections may influence rate movements heading into early 2026.

Economic Data Recap

Last week included a blend of delayed September and October releases alongside fresh November data. The standout was the September PCE inflation index— the Fed’s preferred inflation measure—reported on Friday. PCE came in exactly as expected and is currently running at 2.8% year over year.

While inflation remains above the Fed’s 2% target, the narrative has shifted toward softening labor conditions, meaning last week’s inflation reading had minimal market impact.

This week is relatively quiet for economic data, with no major market-moving releases. Market participants will be watching Wednesday’s Fed announcement closely, followed by a packed schedule of Fed speakers on Friday who are expected to elaborate on the Committee’s policy direction.

Market Snapshot: Monday Morning

So far today, MBS prices are down slightly by approximately 5–10 basis points compared to Friday’s close, and the 10-Year Treasury yield is up 5 basis points to 4.19%.

Looking Ahead

As we enter the final stretch of 2025, all eyes remain on the Fed’s messaging and forward guidance. The decisions and tone this week will help shape expectations—and potentially the rate environment—for early 2026.

Wishing everyone a productive and positive week ahead as we close out the year.