Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

This week’s market update highlights rising mortgage rates, despite recent cuts to the Federal Reserve’s benchmark rate. Inflation is slowing down, but it’s still above the Fed’s target, which means more rate cuts might not happen soon. With no major economic data this week, the focus is on the new Trump administration’s upcoming executive orders, which could impact financial markets.

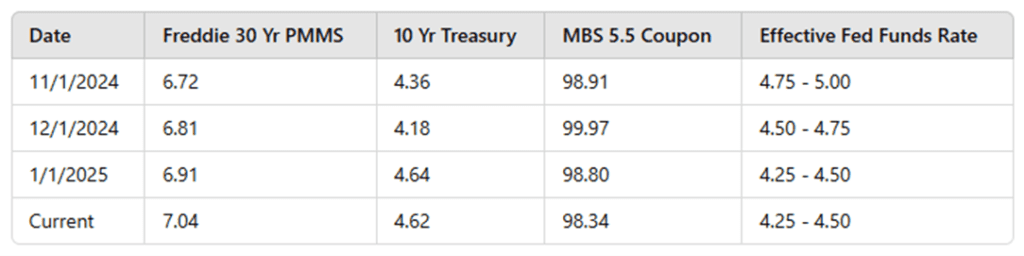

Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

“The Federal Reserve has cut its benchmark rate by 100 basis points since September 18th. However, this reduction in the Fed Funds Rate has not been reflected in mortgage rates, which have continued to rise throughout the end of 2024 and into 2025.”

Mortgage Rates and Market Trends

Despite the Federal Reserve cutting its benchmark rate by 100 basis points since September 18th, mortgage rates have not followed suit and have continued to rise into 2025.

Hotter-than-expected jobs data from December, with non-farm payrolls rising by 256,000 against an expectation of 155,000, pushed bond yields and mortgage rates higher, with the 10-year Treasury peaking around 4.80%. However, last week’s inflation data (CPI and PPI reports) met or slightly underperformed expectations, signaling that inflation may not be accelerating as the Fed had feared. This led to a minor relief rally on Thursday and Friday, with MBS pricing improving by about 75 basis points. Nonetheless, inflation remains above the Fed’s 2% target, and the Fed will likely wait for a continued downward trend before considering more rate cuts. The upcoming Fed FOMC meeting is expected to maintain the current rates, with markets now predicting just one rate cut later in the year and a low probability of multiple cuts.

What to Expect This Week

This week is light on new economic data, with no major market-moving releases scheduled. The focus will shift to the inauguration of the new Trump administration. Up to 100 executive orders are anticipated early in the presidency, potentially impacting global trade and immigration policies, which could affect financial markets.

Markets are closed today in observance of Martin Luther King Jr. Day and will resume trading tomorrow. We’ll be watching for a continuation of the rally that began last Thursday.

We’ll watch the market for changes—check back next week for updates. If you’d like to discuss your homeownership goals, feel free to reach out! We’re happy to help.