Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

Mortgage rates moved slightly higher last week, with the 30-year fixed rate at 6.22%, while the Fed cut rates by 25 basis points as expected. Markets are now focused on upcoming employment and inflation data, which could influence the Fed’s outlook and drive increased volatility this week.

Let’s take a closer look at what’s driving this week’s rate movements and economic sentiment.

“This week there is a good deal of data being released including the delayed November employment report on Tuesday, CPI on Thursday, and the delayed October PCE inflation index on Friday. This week’s data should help clarify whether the risk of inflation or the weakening labor market deserves greater attention from the Fed.”

Rate Trends and Market Drivers

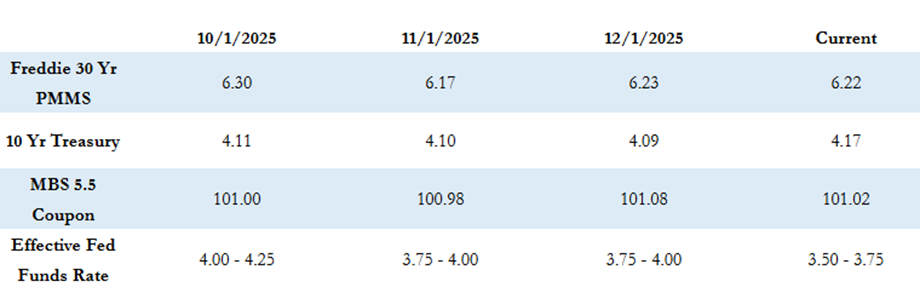

The Freddie Mac average 30-year fixed mortgage rate stood at 6.22% as of last Thursday, reflecting an increase of 3 basis points from the prior week. Based on this, the estimated maximum APR for 30-year fixed-rate loans this week is approximately 7.72% (6.22% plus 1.50%). Meanwhile, the 10-year Treasury yield closed last week at 4.19%, up 5 basis points on the week.

As expected, the Federal Open Market Committee (FOMC) lowered its benchmark federal funds rate by 25 basis points last week. While the rate cut was widely anticipated, the decision was not unanimous, with several members favoring a pause. Additionally, the Fed’s latest Summary of Economic Projections (“dot plot”) currently indicates only one rate cut projected for 2026. This outlook, however, remains subject to change, as the Fed continues to emphasize its data-dependent approach while balancing persistently elevated inflation against signs of a weakening labor market.

Economic Data Recap

The Fed continues to acknowledge upside risks to inflation, particularly if tariffs contribute to sustained price increases, although some policymakers believe the impact of tariffs may be largely one-time in nature. On the labor front, Chairman Powell noted during his press conference that recent payroll gains may be overstated, suggesting that actual job creation could be negative. Notably, there are two months of delayed or missing employment data that must be backfilled prior to the Fed’s January meeting, beginning with the delayed November employment report scheduled for release this Tuesday. Should Chairman Powell’s concerns be confirmed by incoming data—and if labor market weakness persists into early 2026—the outlook for next year could shift toward additional rate cuts rather than fewer.

This week features a heavy slate of economic data, including the delayed November employment report on Tuesday, CPI on Thursday, and the delayed October PCE inflation index on Friday. These releases should provide greater clarity as to whether inflation risks or labor market deterioration warrant greater focus from the Fed. In addition, several Fed officials are scheduled to speak throughout the week, and markets will be closely watching for further insight into the Fed’s policy strategy heading into 2026.

So far today, MBS prices are generally flat relative to Friday’s close, while the 10-year Treasury yield is down 1 basis point to 4.18%. Market activity remains relatively subdued, though volatility could increase beginning tomorrow with the release of the November employment data and additional inflation reports later in the week.

Have a great week!