Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

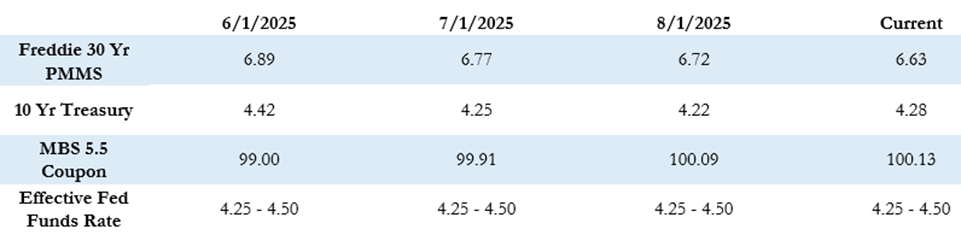

Mortgage rates dipped last week, with the Freddie Mac 30-year fixed average falling to 6.63%, breaking a months-long range. The 10-year Treasury yield rose slightly to 4.28%. All eyes are on this week’s CPI and PPI inflation reports, which could determine whether the Federal Reserve moves forward with a widely expected 0.25% rate cut in September. Mixed economic data—slowing job growth and inflationary pressures from tariffs—has left the Fed in a tough balancing act. Investors are watching closely, as higher-than-expected inflation could delay rate cuts, while softer readings would strengthen the case for easing.

Let’s take a look at the latest trends, rate movements, and what to watch for in the days ahead.

“A higher than expected CPI or PPI print would challenge the case for a rate cut in September, but if the number comes in below expectations that would reinforce the expectation of a more accommodative Fed policy going forward.”

Rate Movement

The Freddie Mac average 30-year fixed rate is at 6.63% as of last Thursday and was down sharply by 9 basis points compared to the prior week. That puts the max APR this week for 30-year fixed rate loans at roughly 8.13% (6.63 + 1.50).

The index had been in the 6.70–6.90% range since mid-April, and it is encouraging to see it finally break out of that range to the downside. The 10-year Treasury yield closed last week at 4.28%, which was up by 6 basis points for the week.

Economic and Fed Outlook

Last week was light in terms of economic data and Fed news after a busy one the week prior. The Fed has been digesting mixed data and has faced political pressure to cut rates sooner rather than later.

Chairman Powell has maintained his hawkish stance and stated that he does not believe the economy is currently constrained by the Fed’s policy. However, the employment data suggests otherwise, as the July data came in below expectations and previous months were also revised down.

When the employment data is taken together with the inflation data, the FOMC feels that the picture is still murky and the data is mixed. Inflationary pressure from tariff policy has begun to show up in the data, and this week we’ll see fresh inflation numbers. The CPI is due out on Tuesday, followed by the PPI on Thursday.

The Fed’s Balancing Act

A higher-than-expected CPI or PPI print would challenge the case for a rate cut in September, but if the number comes in below expectations, that would reinforce the expectation of a more accommodative Fed policy going forward.

The Fed is in a tough position this week, balancing the competing pressures of rising inflation due to tariff policy and the softening labor market. This week’s inflation data will be critical in determining the Fed’s next move and whether they are willing to prioritize the weakening employment situation over the inflationary pressures in the economy.

It is widely expected that the Fed will cut rates in September, with the current odds of a 0.25 cut at 86%, but higher-than-expected inflation numbers this week could change that.

Looking Ahead to the September FOMC Meeting

Between now and the FOMC meeting on September 18, we’ll see plenty more data releases that could shift the Fed’s stance and provide the justification they need to finally resume rate cuts.

The FOMC has always had a tendency toward caution, especially after a number of meetings with no change in policy. Historically, when they shift from an unchanged stance to a cut or hike, the committee often moves later than what would be considered optimal. However, it appears that they may be getting close to that elusive shift in policy.

This Week’s Schedule

Other than the inflation data, this week is light on additional reports, but there are also some scheduled Fed speaking engagements throughout the week.

So far today, MBS prices are generally flat compared to where they closed on Friday, and the 10-year Treasury is down a few basis points to 4.26%.

We’ll continue to monitor the markets closely and provide updates as the data and Fed commentary unfold in the weeks ahead.