Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

Mortgage rates have been going up and down but are starting to settle. This week, the Federal Reserve might lower interest rates, which could affect loans and the economy. Important updates on inflation, spending, and jobs are coming out, giving us a better idea of what to expect for 2025.

I hope everyone enjoyed the weekend! Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

“Recent data has been conflicting, with jobs numbers suggesting the economy is cooling, but inflation data showing that inflation remains unrelentingly elevated. Despite this, it is widely expected that the Fed will cut its benchmark rate by 0.25% at their policy meeting this week.”

Mortgage Rates and Market Trends

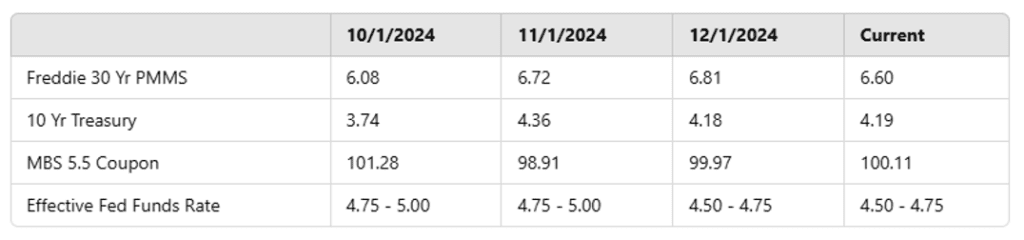

Mortgage rates have stabilized over the last few weeks after rising sharply in the second half of October and throughout November. However, mortgage rates did finish last week on the rise, and despite some substantial relief in the bond markets over the past few weeks, mortgage rates remain at their highest levels since the beginning of August.

Recent data has been conflicting, with jobs numbers suggesting the economy is cooling but inflation data showing that inflation remains unrelentingly elevated. Despite this, it is widely expected that the Fed will cut its benchmark rate by 0.25% at their policy meeting this week. Investors and economists will also be looking forward to the Fed’s plans for 2025 and their key economic indicator forecast, which will be published at the conclusion of the meeting. Beyond this month’s rate cut, expectations have shifted to a “wait-and-see” approach from the Fed, with additional cuts potentially being pushed out to the spring.

What to Expect This Week

This week is busy with fresh data and economic events. The highlight of the week, of course, will be the FOMC rate decision on Wednesday. Aside from that, we will see fresh retail sales, consumer income and spending data, and another Q3 GDP revision. We’ll also see the Fed’s preferred gauge of inflation, the PCE index, released on Friday.

With all of the data being released, along with the Fed’s decision and economic forecast this week, we should have a clearer view of what to expect from the bond markets and mortgage rates as we head into 2025.

So far today, MBS prices are up slightly by about 5-10 basis points, and the 10-Year Treasury is basically flat at 4.40%.

We’ll keep an eye on the market for any shifts—check back next week for our latest updates and insights