Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

Mortgage rates enter 2026 near their lowest levels of the past year as markets continue to assess Federal Reserve policy, labor market strength, and inflation trends. Treasury yields ended 2025 lower than where they began the year, and recent housing data suggests early signs of stabilization. With additional economic data on the horizon, market participants remain cautiously optimistic but firmly data dependent.

Let’s take a closer look at the factors shaping the mortgage and bond markets as the year begins.

“Although affordability remains a major concern, pending home sales rose at the end of the year with the November reading coming in at its highest level since the beginning of 2023. If that momentum continues and rates continue to ease as we head into the peak Spring buying season, then 2026 could shape up to be much better for the mortgage industry than 2025.”

Rate Trends and Market Drivers

Rates have remained in a tight range over the past several weeks, influenced by limited economic data releases, holiday-related market closures, and lighter trading activity. As the market transitions into 2026, there are several reasons for cautious optimism.

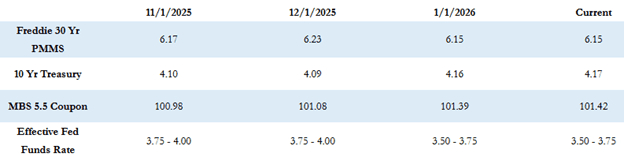

The average 30-year fixed rate declined for three consecutive weeks to close the year at 6.15%, marking the lowest level for the index during 2025. To put that into perspective, the year began with rates near 7.0%. Additionally, the 10-Year Treasury yield finished the year around 4.16%, down approximately 40 basis points year over year.

The Federal Reserve resumed rate cuts toward the end of last year, with most policymakers indicating that one or two additional rate cuts could occur in 2026 if inflation continues to cool. Minutes from the most recent FOMC meeting reiterated expectations that further easing may be appropriate should economic conditions continue to improve.

Economic Data Recap

While affordability remains a challenge for many buyers, housing data showed improvement toward the end of the year. Pending home sales increased, with the November reading reaching its highest level since early 2023. Continued easing in rates could support additional momentum as the market approaches the spring buying season.

On the employment front, recent initial jobless claims have come in stronger than expected, reinforcing the resilience of the U.S. labor market. Employment data scheduled for release later this week will be closely watched, with expectations pointing toward continued strength. Inflation data will return to focus next week with CPI and PPI reports scheduled for release.

Market Snapshot: Current Conditions

So far, MBS prices are modestly higher by approximately 5–10 basis points compared to the prior close, while the 10-Year Treasury yield has edged slightly lower near 4.15%.

Looking Ahead

As 2026 gets underway, markets remain focused on incoming economic data and Federal Reserve guidance. While recent trends point to improving conditions for the mortgage market, rate direction and broader economic momentum will continue to be shaped by inflation readings, labor market performance, and policy decisions in the months ahead.

As new economic data emerges, we’ll break down what it means for rates and the housing market—look for our next update in the week ahead.