Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

“Bond yields edged higher last week amid light economic data and growing speculation around future Fed policy, with inflation and tariff concerns still top of mind. This week brings a busy economic calendar—including CPI, PPI, and Retail Sales—that could shift market expectations for a potential rate cut in September.”

Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

“The minutes from the Fed’s June FOMC meeting were released last week and showed that the FOMC has an increasing preference for cutting interest rates later this year if inflation remains in check. However, they did also call out concerns that new tariff policy could push inflation higher for longer.”

Market Trends and Interest Rates

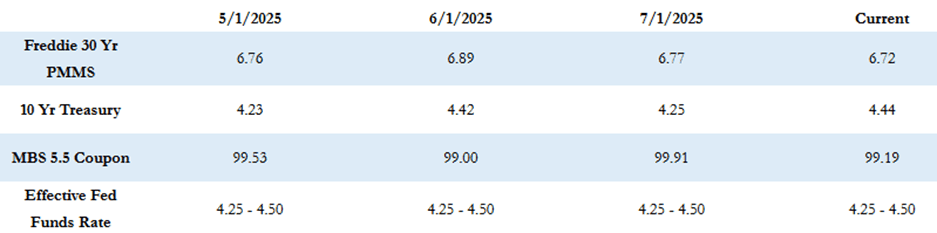

The Freddie Mac average 30-year fixed rate stood at 6.72% as of last Thursday, up 7 basis points from the previous week. That places the maximum APR for 30-year fixed-rate loans at approximately 8.22% (6.72 + 1.50). Since mid-April, this index has remained within the 6.70–6.90% range and currently sits near the lower end. The 10-year Treasury yield closed last week at 4.43%, an increase of 8 basis points over the week.

Last week was light on economic data releases, and as a result, bond yields drifted higher throughout the week. There are signs that consumer fundamentals are beginning to weaken, with recent declines in personal consumption and real income growth. Despite the mixed data, the Fed remains committed to a “wait and see” approach, reinforcing its data-dependent stance.

The release of the June FOMC meeting minutes confirmed a growing preference within the Fed for potential rate cuts later in the year—provided inflation continues to trend downward. However, concerns about new tariff policies raising inflationary pressures were also highlighted. The Fed is clearly in no rush to adjust rates, despite mounting external pressure.

There was also speculation last week regarding potential successors to Fed Chair Powell, as well as calls for his early resignation. The Trump Administration has expressed concern that delayed Fed action could deepen an economic downturn and would prefer a chairperson more inclined toward accommodative policy. While the July Fed meeting is unlikely to yield any rate changes, the probability of a 0.25% rate cut in September has risen to about 60%. Should inflation decline further and labor market weakness accelerate, the likelihood of a September rate cut will increase.

Economic Data to Watch This Week

This week brings a full slate of economic data releases. Key inflation indicators—CPI (Tuesday) and PPI (Wednesday)—will be followed by Retail Sales, Import Price Index, and Consumer Credit reports later in the week. These data points, along with Fed speaking engagements, could significantly influence rate expectations.

Other variables influencing market direction include developments in tariff policy, inflation pressures, and geopolitical tensions in the Middle East. As of this morning, MBS prices are down by roughly 5 basis points compared to Friday’s close, while the 10-year Treasury yield remains flat at 4.43%.

Final Thoughts

This week is shaping up to be an important one for market participants and policymakers alike, with new data and policy commentary likely to shape the path forward. Stay informed and stay focused—there’s a lot still to unfold.