Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

Mortgage rates have been steadily declining for seven weeks, giving homebuyers more purchasing power and increasing refinance activity. This week, the focus is on upcoming inflation data, which could influence the Federal Reserve’s interest rate decisions in the coming months.

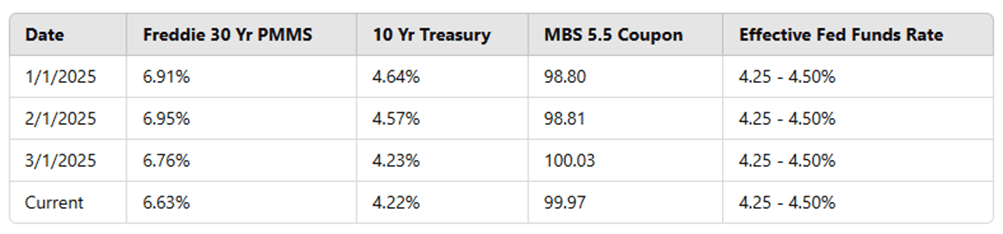

Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

“Rates have been slowly declining for seven consecutive weeks. During this period, mortgage rates have dropped by about 41 basis points from the high of 7.04% in mid-January.”

Market Overview

Mortgage-backed securities and Treasuries have been trading in a very tight range, bringing some stability to a market that has experienced significant volatility over the past year. The decline in rates increases homebuyers’ purchasing power and could provide the push needed for prospective buyers to act. Additionally, the lower rates have already given some existing homeowners the chance to refinance.

According to Freddie Mac, the share of refinance activity has risen to 44%, the highest since mid-December.

It’s been seven weeks since the 10-year Treasury yield peaked at 4.80%. At the time, analysts believed a 5% yield was imminent, and the bond market was pricing in just one 25-basis-point rate cut for the year. As of this morning, the 10-year Treasury yield has dropped by 58 basis points to 4.22%, and Fed Funds futures are now pricing in approximately 65 basis points of total rate cuts for 2025. This shift has been largely driven by a decline in economic growth expectations, as reflected in pessimistic survey results and weak economic data releases.

Employment Data and Market Impact

Last week’s focus was on employment data, with both the ADP report and the official U.S. Non-Farm Payrolls report coming in much lower than expected. These employment reports add to a string of weak economic data releases, fueling expectations that the Federal Reserve may introduce rate cuts by midyear. The FOMC meets next week, but despite recent economic weakness, there is no expectation of a rate cut at this meeting.

The official interest rate decision will be announced on Wednesday, March 19, along with a new dot plot that outlines the Fed’s longer-term outlook on interest rates. This will offer insight into how low the Fed believes rates need to go to reach a neutral level. Inflation remains stubborn, and this week’s focus will shift back to inflation data with the Consumer Price Index (CPI) and Producer Price Index (PPI) set for release on Wednesday and Thursday, respectively. The Fed will analyze this data closely as it refines its rate policy and official statements.

Other than the inflation data, this week is relatively quiet in terms of economic releases. Additionally, the Fed is in its blackout period ahead of next week’s meeting, meaning there will be no scheduled speeches from Federal Reserve officials.

As of this morning, mortgage-backed securities are up about 10-15 basis points compared to Friday’s close, and the 10-year Treasury yield is down sharply by about 10 basis points to 4.22%.

Stay tuned for next week’s market update, where we’ll cover the latest economic data and the Federal Reserve’s policy outlook.