Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

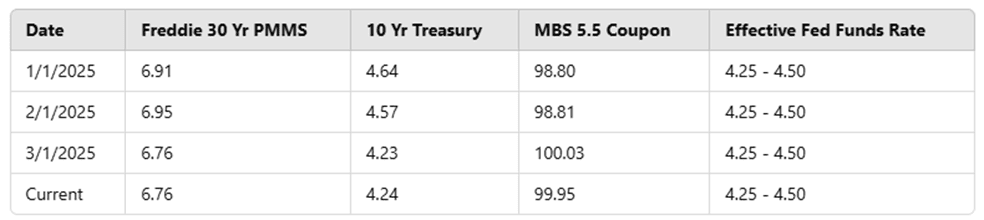

Mortgage rates have been slowly declining for six consecutive weeks, with the average 30-year fixed rate now at 6.76%, and the 10-year Treasury yield dropping to 4.24%. While economic data has been mixed—showing weaker consumer confidence and a slowdown in home sales—stabilizing mortgage rates could help homebuyers as we enter the spring season.

Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

“Expectations have surely changed, and the bulk of this bond market rally has been driven by a deterioration in economic growth expectations, where we’ve seen pessimistic surveys and a few weak economic releases.”

Market Update

Rates have been declining for six straight weeks, but the overall drop has only been about 28 basis points from the high of 7.04% in mid-January. Mortgage-backed securities and Treasuries have been trading in a very tight range, providing some stability to a market that has experienced significant volatility over the past year. While most of us in the mortgage industry would prefer a larger rate decline, at least rates are not rising.

It’s been seven weeks since the 10-year Treasury yield peaked at 4.80%. At the time, analysts believed 5% was just around the corner, and the bond market was pricing in a single 25bp rate cut for the year. This morning, the 10-year yield sits about 55 basis points lower at 4.24%, and Fed Funds futures are now pricing in 64 basis points of total rate cuts in 2025. Expectations have undoubtedly shifted, driven largely by weaker economic growth projections, as indicated by pessimistic surveys and a few weak economic data releases.

Employment Data and Market Impact

Last week, personal income data exceeded expectations, while personal spending came in lower than anticipated. Despite stronger incomes, consumer confidence fell sharply to an eight-month low due to renewed inflation concerns and uncertainty surrounding the Trump administration’s policy changes. The housing market remains challenged, with new home sales showing a sharp 10.5% month-over-month decline. Inventory levels continue to rise, reaching their highest levels since 2008. However, mortgage rates have stabilized and declined slightly over the past six weeks, which should help potential homebuyers struggling with affordability as we head into the spring buying season.

Key Data Releases This Week

This week, the focus will be on the U.S. employment situation. The ADP employment report is set for release on Wednesday, followed by the official U.S. Non-Farm Payrolls report for January on Friday. Additionally, the Federal Reserve will release its Beige Book on Wednesday, providing a comprehensive summary of U.S. economic conditions. Other notable releases include productivity data on Thursday and consumer credit data on Friday. This will be a busy week for economic reports, with key indicators that will help shape the outlook on growth and labor market conditions. Several Federal Reserve officials will also be making public appearances with scheduled speaking engagements throughout the week.

So far today, MBS prices are relatively flat compared to Friday’s close, and the 10-year Treasury yield is down slightly by about three basis points to 4.20%.

Check back next week for Check back next week for market updates, as economic data and Fed insights may lead to shifts in rates and trends.