Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

Bond market trends held steady last week as easing Middle East tensions and mixed U.S. economic data reinforced the Federal Reserve’s data-dependent stance. With inflation cooling and job growth showing signs of slowing, investor focus is shifting toward the rising likelihood of a Fed interest rate cut in September 2025.

Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

The Freddie Mac average 30-year fixed rate is at 6.81% as of last Thursday, a slight decrease of 3 basis points compared to the previous week. This puts the estimated maximum APR for 30-year fixed-rate loans at approximately 8.31% (6.81% + 1.50%).

While intraday volatility remains elevated, average 30-year rates are hovering in the same 6.75–6.85% range they’ve occupied since mid-April. The 10-year Treasury yield closed last week at 4.375%, down 5 basis points on the week.

“If inflation remains to the downside and weakness in the labor market accelerates, then the chances of Fed action in September will continue to increase.”

Market Overview

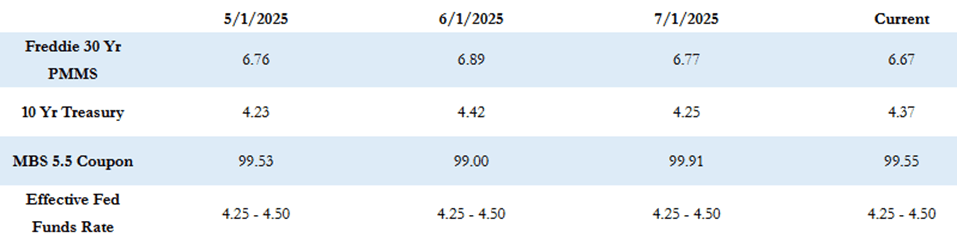

The Freddie Mac average 30-year fixed rate is at 6.67% as of last Thursday, down 10 basis points from the prior week. That puts the max APR this week for 30-year fixed-rate loans at roughly 8.17% (6.67 + 1.50). The index had been in the 6.75–6.85% range since mid-April but finally broke below 6.7% last week. The 10-year Treasury yield closed last week at 4.37%, an increase of 2 basis points from the week prior.

Bond yields drifted down to the low end of recent ranges last week. Geopolitical tensions have eased as the situation in the Middle East has cooled, which has helped calm markets. The key data release was the June U.S. Non-Farm Payrolls report, which came in much higher than expected: 147,000 jobs were created versus the expectation of 110,000. However, there are signs that consumer fundamentals are weakening, with personal consumption and real income growth showing notable declines.

With the data remaining mixed, the Fed has reinforced its wait-and-see, data-dependent stance. Some economists believe the Fed risks not acting soon enough on rate cuts, which could result in a sharper economic downturn. Additionally, the Fed is facing pressure from the Trump Administration to cut rates. Currently, Fed futures markets are pricing in less than a 5% chance of a July rate cut, but the odds of a cut in September continue to improve, with about a 60% chance currently being priced in for a 0.25-point cut. If inflation continues trending downward and labor market weakness accelerates, the likelihood of Fed action in September will grow.

Looking Ahead

There are many moving pieces that both the Fed and market participants must consider, including economic data, the effects of tariff policy, tensions in the Middle East, and persistent inflation. This week’s economic calendar is very light, with the only significant release coming Wednesday with the minutes of the May FOMC meeting. As of this morning, MBS prices are worse by about 10–15 basis points compared to Thursday’s close, and the 10-year Treasury is up by 4 basis points to 4.38%.

Stay tuned for next week’s update as we continue to track market movement and Fed signals in real time.