Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

Mortgage interest rates remained relatively stable last week, though bond market volatility continues to linger. Encouraging inflation data and mixed labor market signals have increased the likelihood of future rate cuts. Meanwhile, global tensions added a layer of complexity to market sentiment. With the Federal Reserve’s June FOMC meeting set for this Wednesday, markets are watching closely for any forward guidance that could influence the mortgage rate outlook in the second half of 2025.

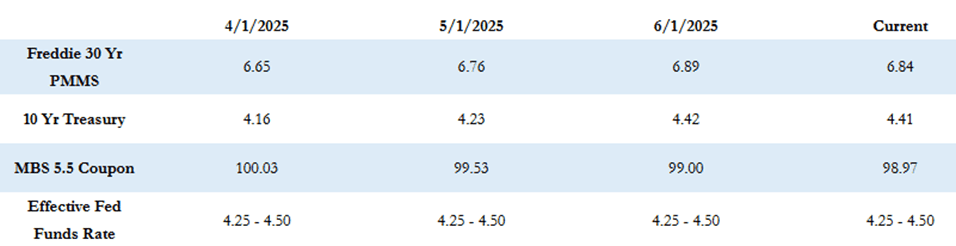

Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

“It’s widely expected that the Fed will keep rates steady at the FOMC meeting on Wednesday. However, with a weakening employment picture and slower price growth the likelihood that the Fed will cut rates later this year is increasing.”

Inflation Data and Global Tensions

Last week brought promising news on inflation. Both the Consumer Price Index (CPI) and Producer Price Index (PPI) came in below expectations, calming some concerns about persistent inflation and contributing to a moderate decline in Treasury yields. The Freddie Mac average 30-year fixed rate was 6.84% as of last Thursday—down 1 basis point from the prior week—keeping the max APR for 30-year fixed loans at approximately 8.34% (6.84 + 1.50).

The 10-year Treasury yield ended the week at 4.42%, a 9-basis-point drop compared to the prior week, reflecting cautious optimism in the bond market.

At the same time, geopolitical concerns reemerged as Israel launched strikes on Iranian nuclear facilities. While such events typically lead to a bond market rally due to a “flight to quality,” the markets remained relatively stable. This anomaly likely stems from inflationary concerns tied to rising energy prices and long-term global risk factors outweighing short-term safe-haven trades.

Fed Meeting in Focus: Will Cuts Come Later This Year?

The Federal Reserve is expected to maintain current rates at the June FOMC meeting. However, with signs of economic cooling—especially in employment data—the market is increasingly pricing in at least one rate cut by year-end. Although May’s payroll data exceeded expectations, rising unemployment claims and downward revisions to prior reports suggest underlying labor market softening.

As of now:

- 25% chance of a 0.25-point rate cut in July

- 50% chance of a cut in September

- Consensus year-end Fed Funds range: 4.00%–4.25%

Fed Chairman Powell’s comments at this week’s press conference will be closely scrutinized for any indication of how the Fed plans to navigate inflation trends, labor data, trade tensions, and global instability in the months ahead.

Market Schedule Note

U.S. financial markets will be closed on Thursday, June 19 in observance of Juneteenth. As a result, any significant reaction to the FOMC’s decision will likely be reflected in Friday’s trading session.

So far today, MBS prices are up approximately 5–10 basis points compared to Friday’s close, and the 10-year Treasury yield has eased slightly to 4.41%.

Thanks for reading—we’ll continue monitoring the data closely. Here’s to staying informed as the market evolves!