Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

Mortgage rates and bond yields are holding steady despite increased geopolitical tensions after U.S. airstrikes in Iran. With key economic indicators on the horizon—including inflation data, housing market reports, and Federal Reserve Chairman Powell’s testimony—financial markets may face heightened volatility as the Fed remains cautious about potential interest rate cuts amid ongoing economic uncertainty.

Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

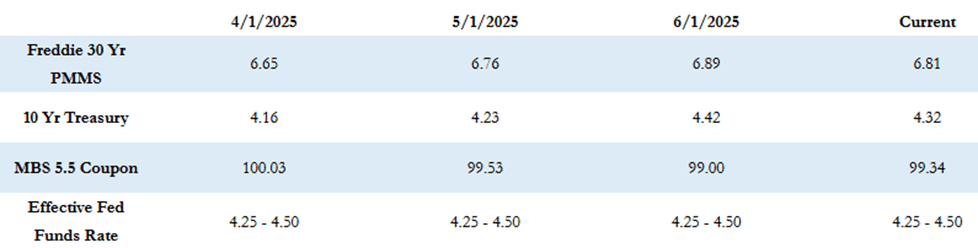

The Freddie Mac average 30-year fixed rate is at 6.81% as of last Thursday, a slight decrease of 3 basis points compared to the previous week. This puts the estimated maximum APR for 30-year fixed-rate loans at approximately 8.31% (6.81% + 1.50%).

While intraday volatility remains elevated, average 30-year rates are hovering in the same 6.75–6.85% range they’ve occupied since mid-April. The 10-year Treasury yield closed last week at 4.375%, down 5 basis points on the week.

“This morning the markets are on high alert after the U.S. bombed nuclear sites in Iran over the weekend. The Trump Administration remains hopeful that Iran will negotiate in the short term, but fears remain that Iran may retaliate with attacks on U.S. personnel at nearby bases, or by disrupting global oil flows through the Strait of Hormuz”

The airstrikes have intensified global geopolitical uncertainty, contributing to a heightened terror threat environment and potential market disruptions. Despite the developing situation, economic data releases remain in sharp focus this week.

Key Economic Data on Deck

This week’s economic calendar is packed with market-moving reports:

- Tuesday:

- New and existing home sales

- Case-Shiller Home Price Index

- Wednesday:

- Q1 2025 GDP revision

- Consumer Confidence

- Thursday–Friday:

- Consumer Sentiment

- Personal Income and Spending

- Friday: Core PCE Index – the Fed’s preferred inflation measure

Also notable is Fed Chairman Powell’s testimony before the House Financial Services Committee on Tuesday, which could influence rate outlooks.

Federal Reserve Outlook

Last week’s central bank headline was the Fed’s June FOMC meeting. As anticipated, the Fed held its target rate steady at 4.25–4.50%, maintaining its cautious stance.

The central bank continues to weigh the effects of new tariff policies on inflation and employment, amid a backdrop of cooling economic indicators. With consumer and labor market data showing signs of softening and now a layer of geopolitical instability, pressure is mounting.

Some economists argue that the Fed may be at risk of waiting too long to initiate rate cuts, which could amplify an economic downturn. However, markets currently assign only a 25% chance of a rate cut at the Fed’s July meeting, with odds exceeding 50% not until September.

Market Volatility Ahead?

With a busy week of economic indicators and increased geopolitical uncertainty, bond markets are likely to remain volatile. As of this morning, MBS prices are up 5–10 basis points, and the 10-year Treasury yield has dipped to 4.32%.

We’ll continue tracking developments and data closely—thanks for reading, and here’s to staying informed as the market evolves.