Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways: Bond Market Trends and Fed Outlook

Mortgage rates have stayed steady over the past few weeks, with the 30-year fixed rate staying below 7% for ten weeks in a row. Treasury yields have also leveled off after dropping since mid-January. This week, all eyes are on March job reports and the possible effects of new tariffs. With economic growth slowing, the Federal Reserve is closely watching the data, and many expect a possible rate cut in June.

Here is this week’s update on the major bond market indices, scheduled Federal Reserve meetings, upcoming market-moving economic data releases, and general bond market trends.

“This week is fairly light in terms of new economic data, but March employment data will be the highlight. The ADP employment report will be released on Wednesday followed by the official U.S. Non-farm Payrolls report on Friday.”

Rate Stability & Affordability

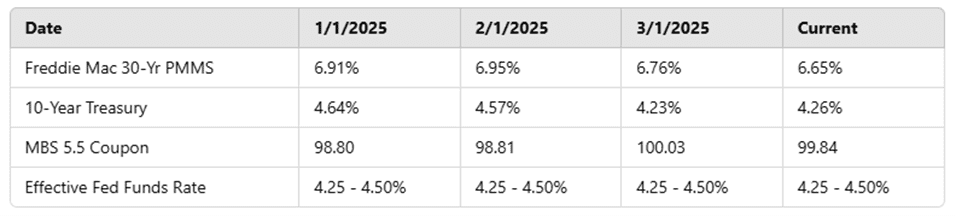

The Freddie Mac average 30-year fixed mortgage rate is at 6.65%, a slight decrease of 2 basis points from last week. For the past three weeks, rates have moved minimally, fluctuating by just a basis point or two. However, the 10-year Treasury yield closed last week at 4.26%, remaining essentially flat for the week.

Over the last 10 weeks, mortgage rates have declined 39 basis points from their January peak of 7.04%, providing some relief for homebuyers concerned about affordability. Likewise, the 10-year Treasury yield has dropped 54 basis points from its recent high of 4.80%, contributing to market stability.

Market Drivers & Economic Outlook

Recent stability in mortgage rates and Treasury yields has been driven by weakening economic growth expectations. Surveys and data releases suggest a slowdown, and inflation remains a key concern. Last week, the Core PCE index (a key inflation measure) came in slightly higher than expected at 0.4% month-over-month and 2.8% year-over-year.

Another major focus is U.S. trade policy. The Trump administration’s proposed tariffs, including those on foreign-made auto parts, will begin to take effect on April 2nd. While some believe these tariffs will help correct trade imbalances and reduce deficits, critics argue they could increase consumer costs, fueling inflation and potentially leading to stagflation (a combination of high inflation and rising unemployment). These concerns have driven long-term inflation expectations to new highs.

Additionally, personal income expectations were revised downward last week, adding to economic uncertainty. The Federal Reserve remains data-driven, with Fed funds futures pricing in an 80% probability of no rate change in May, but a 60% chance of a 0.25% rate cut in June.

Key Events This Week

This week is relatively light on economic data releases, but a few key reports will take center stage:

• Wednesday: ADP Employment Report & New tariffs set to take effect

• Friday: U.S. Non-Farm Payrolls Report

• Throughout the week: Multiple Fed officials speaking, including Chairman Powell on Friday morning

So far today, MBS prices are up slightly, and the 10-Year Treasury yield has dipped a few basis points to 4.22%. Let’s finish March strong and have a great start to April!

Stay tuned for next week’s update and here’s to another impactful week in the market!