Insights and Analysis: Mortgage and Real Estate Capital Markets Update with Jeff Rosato, SVP of Capital Markets at Nationwide Mortgage Bankers.

Key Takeaways:

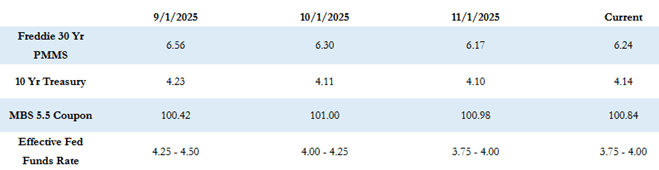

Market uncertainty continues as the longest U.S. government shutdown in history has delayed essential economic data, leaving investors without a clear view of labor and inflation trends. Mortgage rates held relatively steady last week while Treasury yields inched higher, and markets are now looking to the long-delayed September employment report for clarity. At the same time, renewed discussion around a potential 50-year mortgage program has sparked industry attention, raising questions about affordability and long-term equity growth. With key data expected to resume this week, the markets may finally gain direction after weeks of limited visibility.

Let’s break down the latest movements in the bond market and what may be ahead this week

“Key data is scheduled to resume this week with the September employment report expected on Thursday. Once the data starts flowing again clarity will return to the markets.”

Market Overview

The government shutdown—which lasted 43 days—has created an unusual environment of uncertainty, with investors forced to operate without the most critical labor-market and inflation reports. The Fed has emphasized that it cannot commit to additional rate cuts until it can review this missing data, keeping Treasuries and mortgage rates locked in a narrow range for several weeks.

The most significant data gaps include the September employment report and the October CPI and PPI inflation readings. Although Congress passed legislation to end the shutdown last Wednesday night, the flow of economic information is still lagging. With the September employment report expected Thursday, markets are looking for renewed visibility on labor conditions, especially given signs of weakness in the August data and inflation still running above the Fed’s 2% target.

Fed Funds Futures now price in less than a 50% chance of another 0.25% cut in December—down sharply from over 90% just two weeks ago. The Fed has also confirmed it will conclude its quantitative tightening (QT) program in November, which should help put downward pressure on rates as the Fed increases demand for Treasuries and Mortgage-Backed Securities.

Additional Housing and Market Developments

There has been renewed discussion from the FHFA about a potential 50-year mortgage program. While extending the term would reduce monthly payments and ease affordability concerns, it would also significantly slow equity growth for homeowners—raising concerns about long-term wealth building. Rates on a 50-year loan would also be higher than those for the standard 30-year mortgage. Although the concept may offer short-term affordability benefits, it brings tradeoffs that could outweigh its advantages.

Looking Ahead

Economic data is expected to begin flowing again this week, starting with Wednesday’s October FOMC minutes and followed by Thursday’s long-delayed September employment report. Additionally, several Fed governors and presidents are scheduled to speak publicly, offering further insight into the committee’s thinking regarding rate decisions and its assessment of inflation and labor-market strength.

As of this morning, MBS prices are generally unchanged compared to Friday’s close, and the 10-Year Treasury yield has edged slightly lower to 4.12%, reflecting cautious anticipation ahead of the data releases.

Here’s to a focused and informed week ahead as we gain long-awaited clarity from the returning economic data and continue navigating the evolving interest-rate landscape.